Innovation under the sway of financialization: a few selected US issues

François Chesnais, Estratégias de desenvolvimento, política industrial e inovação: ensaios em memória de Fabio Erber / Organizadores: Dulce Monteiro Filha, Luiz Carlos Delorme Prado, Helena M. M. Lastres. – Rio de Janeiro : BNDES, 2014.

The US still has the strongest R&D base in the world and enjoys clear leadership in military technologies. Google, Apple and Microsoft have a near to total global control of information flows. Behind this situation, however, the work done by lucid US researchers raise important issues, related notably to the effects of financialization which are often overlooked elsewhere in the world. This paper examines the new phase in the US debate. It is partly a follow-up to a previous work on innovation in the finance-dominated growth regime, which set in from the late 1980s onwards. It has been written with the memory of conversations with Fabio which would go from one subject to another.

1. Introduction

The United States is the keystone of the world capitalist system and Wall Street is with the City the headquarters of finance. It is also the main, if not the only Western country in which a broad public debate, highly polemical at times, has been going on for over twenty years about the relationships between science, technology and innovation and the main institutions of capitalism, government, corporations, finance and universities. In terms of the number of economists, scientists and political scientists participating in the debate and the number of issues broached, there is no equivalent in Europe. The debate started with the irruption of Japanese products and direct investment in the US domestic market at the end of the 1980s. Some years later it rebounded when the process of financialization, notably in its dimensions of corporate governance and shareholder value maximization, began to have an impact on Research and Development (R&D) and innovation-related investment. In the 1990s the extension of patenting to living organisms and to university research more generally, deemed necessary for industrial corporations, gave rise to a further parallel debate on their likely long-term effects on the “Scientific Commons” and so on the vitality of research1 not only in the USA, but also elsewhere. Since 2005 or so, number of papers and essays by US academics, besides several government or quasi-government reports, have given a new impetus to this debate. The reasons for the vivacity of the US debate are not hard to understand. From the Second World War onwards, the US’s leadership in science and technology was one of the main pillars, if not the most important one, of its hegemony, first within the non-Communist world and then, after 1990, in the global economy and political society.

This paper examines the new phase in the US debate. It is partly a follow-up to previous work on innovation in the finance-dominated growth regime, which set in from the late 1980s onwards, in particular to the contribution written for the 2000 RedeSist-UFRJ conference with Catherine Sauviat on the particularities of the US system, notably its unique venture capital market [Chesnais and Sauviat (2003)].2 The status of the paper is that of an essay. It has been written with the memory of conversations with Fabio which would go from one subject to another. I had first met Fabio at the March 1986 Venice Conference on Innovation Diffusion and later in Rio or in Paris had many discussions with him over a coffee or a glass of wine.

In this essay then, I will start by rapidly explaining how what started as na essentially US-specific finance-dominated growth regime has led to financialization as a historical world epoch. The following sections (second to sixth) pursue the first argument. I start by summarizing some recent provocative arguments put forward again by Robert Gordon in an academic paper [Gordon (2012)], and also by Tyler Cowen for a wider audience [Cowen (2011)]. Both authors examine a number of broad factors that could explain why the US has experienced a falling rate of innovation and certainly a diminishing impact of innovation on growth. Several factors discussed by them concern other Organization for Economic Co-operation and Development (OECD) economies and some could begin to be relevant in countries belonging to the BRICS (Brazil, Russia, India, China and South Africa). The policy responses given by the US Federal Administration, despite an underlying implicit recognition of the factors at work, will then be presented in the third section and their timidity shown. I will then return, in the fourth section, to a major issue discussed in the 2000 paper pertaining to the effects of the 1980 Bayh-Dole Act on university research since it remains very topical in the US debate on its weakening competitiveness in science and technology. The performance of the venture capital market after the 2001 crash on NASDAQ will then be examined in the fifth section. Finally, in the sixth section, I look at some of the evidence concerning the scale and effects of offshoring and outsourcing of R&D by US corporations under the regime of shareholder value maximization. In the seventh section, I turn to the infinitely more important issue of global warming.

2. Financialization, a many-faceted phenomenon

In the 2003 paper written with Catherine Sauviat, the notion of the setting-in of a “finance-dominated accumulation regime” structured our research. Four main features received particular stress: a jump in the degree of direct subordination of the State to capital; the shareholder control of investment-related decisions; a global competitive regime dominated by transnational corporations (TNCs); and finance-dominated patterns of income distribution [Chesnais and Sauviat (2003)]. The question was also examined whether there were factors in the technological base which could be providing an essentially predatory financial regime an element of sustainability over a certain period. At the time, the notion of an accumulation or growth regime dominated by financial investors and financial markets was only really held by the French École de la régulation and a few Anglo-Saxon industrial economists such as Mary O’Sullivan and William Lazonick (2000). Over the last seven or eight years this has changed. Particularly since 2008, the notion of financialization has attracted considerable attention and been an object of much more research than before.

Many definitions of financialization have been given. Gerald Epstein has offered a list [Epstein (2005)]. It includes uses of the term to mean (1) the ascendancy of ‘shareholder value’ as a mode of corporate governance (this is shared by Marxist and non-Marxist left-wing economists alike [O’Sullivan and Lazonick (2000); Deeg and O’Sullivan (2009)]; (2) the explosion of financial trading with a myriad of new financial instruments; (3) the huge political and economic power of the financial elite or oligarchy [Palley (2007)], and as proposed by Epstein himself more broadly (4) the increasing role of financial motives, financial markets, financial actors and financial institutions in the operation of the domestic and international economies. The last definition listed by Epstein is that (5) of a pattern of accumulation in which profit making occurs increasingly through financial channels rather than through trade and commodity production. This is contradicted both by theory and facts. What is commonly named “wealth” (value and surplus in the Marxist terminology) can only be created through the production and successful commercialization of godos and services. When financial investors – banks and investment funds succeed in building a hold on economic activity, a very large part of this wealth is channeled to financial markets in the form of interest on loans to governments, firms and households and of dividend. These markets are the theatre of intense competition on the part of banks and their traders and of fund managers to object of which (even if this is not understood by participants or most observers) is to get as big as possible share of the total flow of interest and dividend. The outcome of this competition (which requires an important dose of collusion, as an unending list of major “scandals,” not least the rigging of the Libor, has shown) appears in the balance sheets of financial corporations as profits. But these are fictitious profits.3 Financial markets do not create value and surplus, but only organize na unceasing series of risk shifting and redistributing operations.

In a filiation with Marx and Hilferding, my own definition of financialization is that of an economic and political configuration or indeed as an epoch, in which the extremely high centralization and concentration both of money capital and industrial capital, along with an increasingly dense intermeshing between the two, have placed accumulation and extended reproduction under the sway of the organizations that embody what Marx names interest-bearing capital. This is capital in the form of stock and bonds (e.g. fictitious capital from the point of view of real investment), which is bent on rent-like or rent-related appropriation as much as on value and surplus-creation. This configuration is conducive to extremely high degrees of income and wealth distribution (the gap between the 1% and the 99%). It is founded on three pillars: the servicing of government debt (and to a lesser degree now of household debt) and so of wealth channeled directly to banks and funds; an ever more diversified range of methods of predatory surplus appropriation developed by TNCs for the benefit of their shareholders and the unabated exploitation of the Planet’s non-renewable resources by mining and agro-industrial corporations, whatever the consequences.

After falling a little during two years, the data shows that interest and dividend-earning capital has succeeded in “decoupling” itself from real accumulation [with world Gross Domestic Product (GDP) growth taken as a proxy] and even to regain the ground lost during 2008-2009. In its 2011 survey of financial assets, the McKinsey Global Institute considers that while the “2008 financial crisis and worldwide recession had halted a three-decade expansion of global capital and banking markets, growth has resumed, fueled by expansion in developing economies, in addition to a $ 4.4 trillion increase in sovereign debt” [McKinsey Global Institute (2011, p. 3)]. The diversification and intensification of predatory surplus appropriation by TNCs led the 2011 edition of the UNCTAD annual report to focus on what it names “non-equity modes of international production.” These are said to

include contract manufacturing, services outsourcing, contract farming, franchising, licensing, management contracts and other types of contractual relationships through which TNCs coordinate activities in their global value chains (GVCs) and influence the management of host-country firms without owning an equity stake in those firms [UNCTAD (2011, chapter 3)].

The relationships between banks and investment funds and oil, mining and agro-industrial corporations are extremely close. On the London Stock Exchange oil, mining and banking head the listing and are the market’s main support. Fighting global warming is not their priority and governments eventually ready to do so will not, to say the least have their support.

3. Faltering Innovation and the Hypotesis of a “Technological Plateau”

I now come to the main strand in this essay, namely that if the hypothesis of a “technological plateau” is accepted then financialization, in the case of the United States at least, is aggravating its possible consequences. The pieces written by Robert Gordon and Tyler Cowen on the possible faltering of innovation and certainly its weakening effect on growth have provoked a lot of debate. If they had been written by Europeans they would have been brushed aside as mere expressions of “euro-pessimism.” They voice concerns which are largely shared by a part of the US scientific community and of the stable non-partisan part of the Washington government structures, revealing issues about which pessimism is shared by both sides of the Atlantic. Given the US’s previous excellence in technology and the central place it still largely occupies in the world economy they are the object of concern for those who look for US leadership.4 Gordon challenges the doxa dating back to Solow’s work in the 1950s on growth as continuous process that could persist forever [Gordon (2012)].5 His arguments are also in sharp contrast with the expectations of a new Great Technological Surge based on IT as defended by Perez (2007).

Gordon’s approach starts with a distinction between major inventions amounting to industrial revolutions and the subsequent “incremental improvements which ultimately tap the full potential of the initial invention” [Gordon (2012, p. 2)]. He reserves the term innovation for the second. Coming back to a thesis that he first presented in 2000, Gordon argues that following the first two industrial revolutions (that of the late 18th and first half of the 19th spread over eighty years and the shorter in time one of the late 19th century), the incremental innovation follow-up process lasted at least 100 years the second overlapping with the first. His most central point is the “once and for all” character of the major technological changes: “Taking the inventions and their follow-up improvements together, many of these processes could happen only once. Notable examples are speed of travel, temperature of interior space, and urbanization itself.” Gordon numbers three “industrial revolutions,” while Carlota Perez counts five which she names “technological.” The two agree in their identification of the computer and Internet revolution as being the latest one. However, while Perez sees a huge potential for growth from IT and views the surge as still having to come, Gordon considers that the IT-based industrial revolution is largely over. He had already argued in his first paper that the increase in productivity growth outside the ICT industries did not exceed 0.4 per cent per annum in the late 1990s. Moreover, it was confined to durables. In services and in non-manufacturing industry, there had been either stagnation or decline in total factor productivity. In his paper for the 2000 RedeSist conference, Christopher Freeman noted that for Gordon “the new paradigm story for the US economy has been greatly exaggerated” [Freeman (2003, p. 1)]. Gordon is still more certain of this than in 2000. The IT-based industrial revolution

began around 1960 and reached its climax in the dot.com era of the late 1990s, but its main impact on productivity has withered away in the past eight years. Many of the inventions that replaced tedious and repetitive clerical labor by computers happened a long time ago, in the 1970s and 1980s. Invention since 2000 has centered on entertainment and communication devices that are smaller, smarter, and more capable, but do not fundamentally change labor productivity or the standard of living in the way that electric light, motor cars, or indoor plumbing changed it (2012, p. 2).

Gordon also stresses the large number of labor-saving improvements made possible by electronics long before the invention and diffusion of the Internet in the late 1990s.

Tyler Cowen shares by and large Gordon’s assessment of IT and the Internet. He considers that while the Internet has been fantastic for the intellectually curious, its direct employment effects are very weak and it has done little to raise material standards of living. According to Cowen (2011), we have a collective historical memory that technological progress brings a big and predictable stream of revenue growth across most of the economy, but, when it comes to the Web, those assumptions are turning out to be wrong or misleading. Both authors consider factors which drove economic growth for most of America’s history are to a large extent spent. Cowen uses the expression “technological plateau” and points to the “low-hanging fruit” which made rapid growth easy, including the cultivation of much previously unused land; the application and spread of what he views much like Gordon as “once and for all” technological breakthroughs, notably electricity, mass communications, refrigeration and sanitation and finally mass education.

In emerging or developing countries, including, in this respect, BRICS with the traits of underdevelopment which linger on with differing degrees of acuity, the diffusion process fed by Gordon’s last two industrial revolutions is not over. Nor has the growth potential of mass education really begun to taped save in China. In this respect, they can still enjoy a part of the low-hanging fruit on condition that the appropriate economic and social conditions are created. For some BRICS, new intensive uses of land represent a transitory low-hanging fruit, the exploitation of which, under the sway of the most strongly rentier segments of financial capital, serves to delay the creation of such conditions.

4. US Policy respondes to declining innovation under the influence of finance

Gordon and Cowen voice concerns which are shared by the stable non-partisan segments of US government. Government or quasi-government reports recently published contain related figures on R&D expenditures which have implications for US’s leadership in science and technology. On the face of things the situation seems satisfactory (most OECD countries would be triumphal about them!). The 2012 edition of the National Science Foundation’s Science and Engineering Statistics reports that “over the last five years (2004-2009), annual growth in US R&D spending averaged 5.8%, compared to annual average growth of 3.3% for US GDP.” It immediately adds that “indeed, over the last several decades, average annual growth in R&D spending has substantially outpaced that of GDP.” This implies the absence of a positive relationship between. The report does not offer any explanation. Besides the long-recognized difficulties stemming from the reporting of their R&D by firm, the lack of positive relationship could reflect the lack of investment opportunities in a phase dominated by financial devices for supporting the single housing market. Further explanations arise from the analysis in later sections. It also reports that development is by far the largest component of US R&D, that business sector funding of basic research in university labs “declined steeply after the 1990s” leaving the federal government do all the funding. A point of concern on the part of the NSF is that “academic R&D has also long been concentrated in just a few S&E fields. For decades, more than half of all academic R&D spending has been in the life sciences” [National Science Foundation (2012, chapter 5)]. The highest representatives of the scientific community have repeatedly expressed their anxieties about changing corporate innovation-investment-related priorities in the context of globalization and called for increased federal funding of basic research and scientific education. In 2005, the US National Academy of Sciences, the US National Academy of Engineering and the Institute of Medicine published report entitled “Rising above the Gathering Storm.”6 In a 2010 update, the gathering storm was said to be approaching “force category 5.” Despite the reference to the hurricane, the report is not about the threats of climate change or about the pursuit of scientific endeavor in the general interest. Very prosaically, it calls for increased spending to offset the fall in US competitiveness in not only science as measured by scientific publications, but also patenting by US corporations. It pleads for long-term investment in science (a ten per cent annual increase in federal funding of basic scientific research for seven years) and in scientific and technical education and points to the different ways in which commitments to increased federal support were not met even before 2008. The key question of the subordination of science to the market and the need to assess the effects of the 1980 Bayh-Dole Act on the working of the universities is not even raised despite the warnings to which we turn below. The offshoring of laboratories by US corporations and the outsourcing to Asia of much of their development activities using the facilities of ITCs are deplored but not really questioned because it would mean challenging corporate management strategies under the regime of maximization of shareholder value and moving away, if only a little, from the accepted canons of finance capital-dominated government policy making.

The timidity and defensive character of the responses express the power relationships between financial capital and government and more fundamentally those between capital and labor of course. This is particularly true of the long and in appearance ambitious report put out in 2012 by the Department of Commerce on “US Competitiveness and Innovative Capacity” [US Department of Commerce (2012)]. It lists six “alarms” which should justify massive federal investment in science and technology, education and infrastructures. The report was prepared in the lead up to the presidential elections and so the alarms are listed in an order corresponding to the needs of Obama’s campaign. First, employment (“the United States’ ability to create jobs has deteriorated during the past decade”); second, wages and the situation of the “middle class which has struggled as incomes and wages have generally stagnated;” third, the erosion since 2002 of the US’s trade surplus in “advanced technology products,” (biotechnology products computers, semiconductors and robotics) with an $ 81 billion trade deficit in 2010 (the 2002-2010 period is exactly that of the Bush-Greenspan priorities on war in Iraq and Afghanistan and debt-enhancement in housing and construction but the parallel is not made); fourth, innovation “after reviewing 16 key indicators, number of scientists and engineers, corporate and government R&D, venture capital, productivity, and trade performance etc., the July 2011 Atlantic Century report indicated that the United States had made little or no progress in its competitiveness since 1999;” fifth, education (the “United States is struggling to prepare US students in math and science”); and finally, infrastructure (“delays at airports, time lost in traffic jams, bridges in need of repair, and ports that cannot handle the newest ships exemplify how traditional infrastructure in the United States has failed to keep pace with its growing population”).

These six “alarms” do not lead the Department of Commerce to take an offensive stance. It almost apologizes for advocating increased federal investment. Just to take the example of science and technology, the report starts by absolving finance and industry from any responsibility in underinvestment in R&D. One of the most reactionary tenets of neoclassical doctrine is called on, namely the theory of public goods and the divergence between social and private returns to investments due to the free availability or non-excludability of scientific knowledge, to absolve business. “It may not be possible for those conducting basic research to fully appropriate the benefits from research and innovation” since “the social benefits (those that accrue to society as a whole) from these innovative activities are likely exceed the private benefits (those that accrue just to the entity conducting the research)” [US Department of Commerce (2012, chapter 3)].7 This is why basic research must be funded publicly and the results made available to firms which can then privatize them in ways and at a pace defined by corporate strategies. The report’s main argument for increased federal spending thus consists essentially of a long reminder list of the key innovations due to federal R&D and procurement along with the names of the corporations that built their profits on them: the transistor in the Bell Labs at the time of ATT (American Telephone & Telegraph Company); semiconductors with Intel, IBM, Hewlett-Packard, and Texas Instruments as major beneficiaries;8 Internet and Google;9 the National Institutes of Health (NIH) and “the creation and expansion of the biotechnology industry.” Here the report cites Genentech (fully owned by Hoffman-La Roche since 2009) as the most striking success. But it also gives more recent examples such as Protea Biosciences, which holds a dominant position in protein-coding genes with the backing of NIH funding. It is interesting to note that while defense R&D accounts for 58% of US federal outlays, the examples of technological spillovers given in the report date back to the late 1980s.

Chart 1: Inflation-adjusted increase in federal research funds, by S&E field. 2000-09

The breakdown of federal funding of R&D by science and engineering fields gives a good indication where priorities shaped by preoccupations about military superiority (which is very understandable), competitiveness (that of the pharmaceutical industry particularly) and support to the venture capital market prevail over environmental or social objectives. The 2005 Joint Academies Report pointed out the federal funding of research in the physical sciences as a percentage of GDP was 45% less in 2004 than in 1976. It talked about “shortsightedness” and “risk aversion” by federal funding agencies.10

5. The impacts of the Bath-Dole act on the “Scientific Commons”

What the Department of Commerce report both says and does not say about the effects on the US research system of the privatization of the results of basic research and the total silence of the Gathering Storm reports are significant of the damage wrought by the finance-dominated regime in the university research system. In 1980, a Supreme Court decision in the Diamond vs. Chakrabarty case laid down that genetically engineered life forms were patentable. The same year the privatization of scientific knowledge generated in universities was enhanced by legislation. As stated in the preamble of the 1980 Bayh-Dole Act, the aim was “to cut down on bureaucracy” in the access of business to the results of basic research and to “encourage private industry to utilize government financed inventions through the commitment of the risk capital necessary to develop such inventions to the point of commercial application.”Expanded technology commercialization was to be accomplished by “employing the patent system to augment collaboration between universities (as well as other nonprofit institutions) and the business community and ensure that inventions were brought to market” [Schacht (2009, p. 2)]. By 1988 the implications of the Act were sufficiently clear for Partha Dasgupta and Paul David to warn that economic growth under conditions of “privatization of science” might continue to be grounded in the exploitation of scientific and technical knowledge, but it would lose its sustained character [Dasgupta and David (1988)]. In another study, Richard Florida argued that because universities were seen as “engines” of growth, they were focusing on applied rather than fundamental research. According to Florida (1999), national and local policies and practices were encouraging the commercialization of academic research at the expense of knowledge creation. By 2000, the assessment could be made that codes of behavior within academic institutions were rapidly eroding. Professors often owned stock in the companies that funded their work or accept extra rewards in the form of stock-options. Universities with research laboratories had set up technology-licensing offices to manage their patent portfolios,

often guarding their intellectual property as aggressively as business does and doing so in some cases against their own research staff. Universities with limited budgets are investing large resources in commercially oriented fields of research, while downsizing humanities departments and curbing expenditures on teaching. They had become eager co-capitalists, embracing market values as never before.11

Today, the issue is as topical as ever. In one of the most recent assess ments of the situation the political scientist Philip Mirowski concludes that the harm done to science in the US (and of course in all countries following the US example) amounts to a qualitative degradation in the special nature of the knowledge produced [Mirowski (2011)]. The 2010 Department of Commerce report prefers to consider that the results of the Bayh-Dole Act are disappointing: a particular motive of concern is the “slowdown in commercialization of technologies by US universities since 2000.” The Act

was meant to provide a strong incentive for universities to offer useful technology to industry, who would then quickly transform it into products. By the late 1980s, university patenting, licensing of technology to industry, and the proliferation of university-linked startup companies all began to accelerate, reaching especially high growth rates in the late 1990s. However, the pace of these activities slowed starting in 2000, a slowdown that persisted after the brief recession of the early 2000s [US Department of Commerce (2012, chapter 3)].

This is partly due to the retreat of venture capital after the NASDAQ 2001 crash, which is examined below, but it may also be an indicator of dwindling patentable knowledge. One would have thus expected the Department of Commerce report to begin assessing the possible effects of the Bayh-Dole Act on the production of basic research and discussing at least the advisability of amending it.

Work exists to this effect. In one of several articles on the effects of Diamond v. Chakrabarty and Bayh-Dole, Richard Nelson wrote in 2004 that while the privatization of the scientific commons is relatively limited, there are real dangers that, unless halted, soon significant portions of future scientific knowledge will be private property and fall outside the public domain, and that could be a difficult for both the future progress of science, and for technological progress [Nelson (2004)]. Nelson argues that technological advance is a collective, cultural, evolutionary process. A strong body of scientific understanding of a technology serves to enlarge and extend the área within which an inventor or problem solver can see relatively clearly and thus make informed judgments regarding what particular paths are promising as solutions, and which ones are likely to be dead ends. With regard to basic science “research outputs almost never are final products themselves, but have their principal use in further research, some of it aimed to advance the science farther, some to follow leads that may enable a useful product or process to be found and developed.” Thus his concern “about not hindering the ability of the scientific community, both that part interested in advancing the science farther, and that part interested in trying to use knowledge in the search for useful product, to work freely with and from new scientific findings” [Nelson (2004, p. 463)]. Nelson and his colleagues12 call for amendments to the Bayh-Dole Act.13 This would have to be done in the general interest of the pursuit of science because of the creation, since the double turn of 1980, of strong vested interests: “Many university administrators and researchers certainly would resist such an amendment, on the grounds that it would diminish their ability to maximize financial returns from their patent portfolio.” Nelson (2004, p. 467) writes that “in the era since Bayh-Dole, universities have become a major part of the problem, avidly defending their rights to patent their research results, and license as they choose.” Many have ceased “supporting the idea of a scientific commons, except in terms of their own rights to do research.” Similarly, Philip Mirowski considers that the roots of academic commerce run deep. “Bayh-Dole was just one component in a whole range of roughly simultaneous ‘reforms’ being engineered into corporations, the government, and the universities, all calculated to instigate the marketplace of ideas throughout the entire culture” [Mirowski (2011, p. 149)]. If he or Nelson and his colleagues are right it is understandable that the committees that wrote the “Gathering storm” reports make no mention of Bayh-Dole.

6. The Posto-2001 performance of venture capital financing of inoovation

The venture capital industry is finance capital’s original distinctive contribution to the financing of R&D. From the mid-1990s on it became very central to the organization of funding in the USA. For a long time an exceptionally large part of total R&D expenditures financed by the federal government but performed in industry was a central feature of the US national innovation system. The 2005 Joint Academies Report notes the overall retreat of the large corporations:

Some of the most important fundamental research in the 20th century was accomplished in corporate laboratories—Bell Labs, GE Research, IBM Research, Xerox PARC, and others. Since that time, the corporate research structure has been significantly eroded. One reason might be the challenge of capturing the results of research investments within one company or even a single nation on a long-term basis [National Academy of Sciences; National Academy of Engineering; Institute of Medicine (2005, p.32)].14

This retreat does not show up in the figures. On the contrary from the early 1990s onwards, on account of venture capital’s interest in innovative dot.com and biotech firms, the share of total funding financed by the private sector grew very fast. Business R&D outlays represented 70% of total US R&D expenditure in 1999. It then fell for five years before remaining on a plateau until the new drop in 2009 on account of the 2008-09 financial crisis and economic recession [National Science Foundation (2012, chapter 4)]. The increase in the business funding of R&D in the 1990s took place during the very period in which the doctrine of share holder value was taking complete hold over the management of corporations and the “short-termism” denounced by a wing of US economists [Dertouzos et al. (1989)]. The support of R&D by venture capital does not belie “short-termism.” It involves a change in the actors and in the locus and nature of decisions shaping the future of research projects. R&D carried out in corporate laboratories declines. Corporations quoted on the Stock Market can buy back shares rather than invest in R&D [Lazonick (2012a; 2012b)].The uncertainties and risks inherent to research are assumed by venture capitalists. They become closely linked to financial speculation and a significant part of funding depends on the state of financial markets.

The venture capital financing of R&D requires a very specific set of systemic relationships. Both the evolution of the venture capital market over the past decade and data published recently on the annual rate of startups make their degree of fragility clearer than in 2000. For a venture capital industry to emerge one must first have a strong and regular flow of talented scientist and engineers in a position to “walk out of the door” of university laboratories with their patents and their specific knowledge or again to negotiate their departure from large corporations in order to set up, with the help of venture capital, their own company in the expectation of large financial rewards. For this to take place the law and the practice of the academic world must first have undergone the changes that make this “migration” legally possible if not encouraged and on the whole accepted and even envied within academia as an institution. But for the flow to be regular and venture capital firms kept interested the “rate of production” of new knowledge must not abate.

Venture capital firms are specialized intermediaries between the small or very technology-intensive or “laboratory-type” firms and financial investors decided on using part of their funds to make high-risk investments in a range of markets including technology. Venture capitalists use the funds placed under their management plus those that they borrow to provide investment finance dedicated to start-ups or early-stage innovative companies with high growth potential high technology development. In the 1990s, pension funds were far the largest investor groups, holding roughly 40% of capital outstanding and supplying close to 50% of all new funds raised by partnerships.15 The last condition that must be satisfied is ease of exit for venture capital through an initial public offering (IPO) of shares on specialized markets or the sale of the firm to a large corporation.

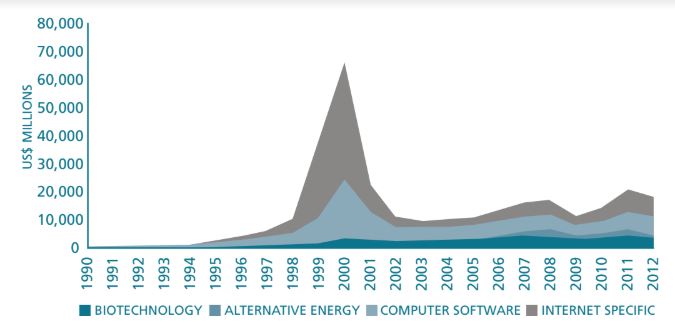

Chart 2: VC investment in four selected industries in the USA

As can be seen from this figure, venture capital investment never recovered from the crash of the Internet bubble on NASDAQ. From 2003 onwards speculative capital was more interested in mortgage than in technology. Levels of venture capital investments were only marginally affected by the busting of the housing bubble during the 2007-2008 financial episode of the on-going world economic and financial crisis. But as will be seen below the sharp fall in IPOs disrupted the venture capital system taken a whole. The distribution among the four broad industry groupings became more balanced after the bursting of the dot.com bubble with the evident exception of alternative energy. Misgivings about biotechnology funding will be discussed below.

Venture capital investment is broken down between early stage investment (seed, startup), expansion or “second round financing” which provides working capital for company expansion preparatory to initial public offering and later stage investment which includes acquisition-financing and management and leverage buyouts. In 2004, the National Science Foundation stressed that “contrary to popular perception, only a relatively small amount of dollars invested by venture capital funds ends up as seed money to support research or early product development.” In the latest 2012 report, the assessment is that

venture capital investment has become generally more conservative during the 2000s. Later stage venture capital investment has both grown in absolute terms and as a share of total investment. The shift to later stage, more conservative investing has been attributed to a desire for lowered investment risk, higher minimum investment levels, a shorter time horizon for realizing gains, a decline in yields of venture capital investment, and the sharp decline in IPOs and acquisitions of venture capital-backed firms, which has required venture capital investors to provide additional rounds of financing. [National Science Foundation (2012, Chap. 6, p. 59)].

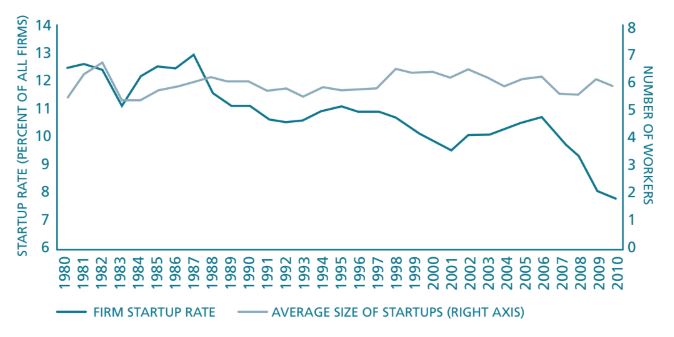

The report adds that “another possibility is that venture capital investor behavior changed because fewer opportunities for attractive risky investments were available in the 2000s than in the 1990s.” [National Science Foundation (2012, Chap. 6, p. 71)]. The following figure published by the Bureau of Census is included in the Department of Commerce report with the commentary that it could mean that “fewer would-be entrepreneurs are raising to the challenges of turning new ideas into new businesses” [US Department of Commerce (2012, Chap. 7, p. 6)].16 But it can also be interpreted as an indication of the validity of the “technological plateau” hypothesis and the legitimacy of the fears regarding the weakening of the scientific commons.

Chart 3: Declining pace of =rm startups, US private sector, BDS

The particular case of venture capital in the biotech sector has been subjected to much analysis, starting with that of Gary Pisano, professor at the Harvard Business School. In the 1990s the biotech sector attracted more genuine early stage investment (seed, startup) than other industries. Subsequently it appeared to “be retreating from its distinctive position at the radical and risky end of the R&D spectrum” [Pisano (2006)].17 The bursting of the Internet bubble coincided and aggravated the effects of the rise of strong disillusions about time-horizons and expectations of returns in the support of genomics (the mapping of human genes and resulting therapies). Industry specialists even refer to a “genomics bubble”18 the bursting of which in 2001 went unremarked on account of the Internet collapse. After 2001, the strategies of startups and the preferences of venture capitalists underwent

a marked change. Rather than forming so-called molecule-to-market companies, whose first product revenues might be more than a decade away, entrepreneurs and investors began to look for lower-risk, faster-payback models, such as licensing existing projects and products from other companies and then refining them [Pisano (2006, p. 118)].

Given the importance acquired by the venture capital market, “the change in strategies raises a major concern: If young biotech firms are not pursuing cutting-edge science that will focus on the higher-risk long-term projects that offer potential medical breakthroughs?” [Pisano (2006, p. 118)].

In an interview, Pisano put his findings and assessment very bluntly:

Science and business work differently. They have different cultures, values, and norms. For instance, science holds methods sacred; business cherishes results. Science should be about openness; business is about secrecy. Science demands validity; business requires utility. So, the tensions are deep. What has happened is that we have tried to mash these two worlds together in biotech and may not be doing either very well. Science could be suffering and business certainly is suffering. If you try to take something that is science, and then jam it into normal business in stitutions, it just doesn’t work that well for either science or business [Silverthorne (2006, p. 1)].

In a follow-up to Pisano, the particularities of venture capital funding of biopharmaceutical R&D and the perspectives of this industry have been investigated in research led by William Lazonick. In a paper with Öner Tulum, he finds that the greatest vulnerability comes from lack of liquidity in overall unfavorable financial market conditions of firms that are quasi-financial as- sets. Investors will put money into firms whose sole “capital” is knowledge, only if exit through IPOs is guaranteed [Lazonick and Tulum (2011)].

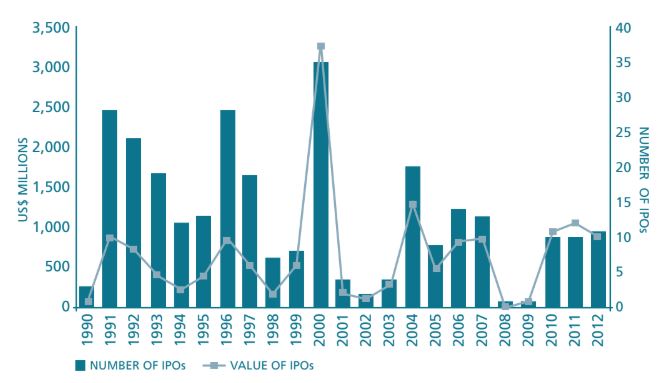

As shown in this figure made by Mustafa Erdem Sakinç in ongoing PhD research supervised by Lazonick in biotech, the IPO market never really recovered from the 2000 crash on NASDAQ. In 2008 and 2009 it was badly hit by the subprime crisis and then the September 2008 panic after the failure of Lehman Brothers. Indeed, the IPO market practically disappeared before reviving a little. Lazonick and Tulum doubt whether the emergence of the small numbers of successful drugs from biopharmaceutical research would have occurred without NIH funding. They raise the question of the social costs of leaving the application of findings stemming from public funding in the hands of firms particularly subjected to the state of financial markets. The funding criteria of the NIH itself was scrutinized by the 2005 Joint Academies Report and found to be very conservative.19

Chart 4: Biotechnology IPOs in the USA

7. Science and Technology offshoring and outsourcing and the US “Industrial Commons”

We must now look at a part of the discussion and data concerning the scale and effects of offshoring and outsourcing of R&D by US corporations under the regime of shareholder value maximization. A theme which has been heatedly debated among economists in American business schools is the deteriorated state of the US “industrial commons.” By this term, Gary Pisano and his colleague at the Harvard Business School Willy Shih mean the “R&D and manufacturing infrastructure, know-how, process-development skills, and engineering capabilities resulting from the clustering of universities, suppliers, and manufacturers” [Pisano and Shih (2009, p. 1)]. They consider that their case-study research shows that in industries where constant interaction between R&D and manufacturing is important, notably in those where rapidly-developing innovations in processes and process technologies are taking place, the outsourcing of manufacturing to other countries proves to be destructive not only to the innovative process in the individual firm, but also to the industrial commons of a whole set of firms. Pisano and Shih argue against the “prevailing view that the migration of mature manufacturing industries away from developed countries is just part of a healthy, natural process of economic evolution that allows resources to be redeployed to new, higher-potential businesses.” It simply “ignores the fact that new cutting-edge high-tech products often depend in some critical way on the commons of a mature industry. Lose that commons, and you lose the opportunity to be the home of the hot new businesses of tomorrow.” This article sparked off a strong blog debate20 leading to a book in which Pisano and Shih sum up their replies to their critics [Pisano and Shih (2012)]. For economists and political scientists who have long worked on technology, many points made are a little déjà-vu: the benefits of industrial and technological clustering for instance (Italian industrial districts are cited) or the imperatives of close interaction between R&D and on-site production. But after nearly three decades of neoliberal-neoclassical domination these ideas are welcome and their reappearance a sign of the many impasses experienced in the heartland of world capitalism.

The issue raises two questions: first, did the US ever really have, bar ing a few exceptions, true “industrial commons” as defined by Pisano and Shih and second, is their destruction or significant weakening the straightforward result of liberalization and globalization or must they be attributed specifically to financialized corporate management as it has developed over the past three decades? Only American scholars can answer the first question. I will attempt to sort out the second a little. Two of the consequences of liberalization and globalization taken together are the increased opportunities for foreign direct investment (FDI) and the intensification of oligopolistic rivalry in truly global markets. FDI by TNCS has always called for and been accompanied by the setting up of R&D facilities of the variety named support labs doing work adapting production to local conditions, primary inputs but more generally customers habits and so markets. Once this is considered, then TNC R&D investment in countries with large and expanding markets is first and often remains the straightforward result of their FDI. The upgrading of R&D capacities follows the increased sophistication of domestic demand and the growth of the competitiveness of local firms. The other dimension of globalization is the intensification of competition as domestic oligopoly gives way to global oligopoly. In industries where as studied by Deiter [Ernst (2009)] the “modularization” of engineering, development and research can be organized, the setting up or upgrading of foreign laboratories may become part of networking strategies by TNCs confronted by acute oligopolistic rivalry. These factors in combination with wage levels, skill availability and attractive economies of agglomeration can well push TNCs to offshore part of the overall corporate R&D. These patterns correspond largely to those of US TNC R&D investment in China.

The first and still the most complete account of foreign direct investment in R&D facilities and the setting up of laboratories abroad was published by UNCTAD in 2005 [UNCTAD (2005, chapter 5)]. No data comparable in detail covering the main host and home countries has been published since. However China has been well researched as a host country meaning that data exists, while the US has surveyed regularly the foreign R&D activities of its TNCs. This makes it possible to measure the scale and discuss some of the features of US TNC R&D investment in China. The latest US data indicates that the share of US-owned affiliates R&D performed in China rose from a half percentage point or less in 1997 to 4% in 2008.21 The findings of research led by Nannan Lundin in Sweden [Lundin and Serger (2007)] and work carried out by Li Yanhua for the BRICS-Rede-Sist project [Yanhua (2013)] indicate that adaptive R&D [UNCTAD (2005, chapter IV)] in support of FDI accounts for the largest part of foreign R&Dactivities in China. TNCs have then sought to take advantage of the large and growing pool of skilled engineers and technicians as well as cutting their overall research expenditures. A few have started to build R&D facilities within globally integrated corporate structures along the modularized model; others have done so simply to increase their share of the Market and fight off indigenous competitors. General Motors is a major example. The very large R&D facilities set up in China are globally integrated but continue to be almost entirely devoted to adaptive work.22 In the setting up of R&D facilities by foreign firms, government pressure is also at work. In given industries, foreign investors are required to offer counterpart activities notably, the transfer of technology and/or the commitment to invest in R&D. The wholly owned affiliate is the main ownership mode of TNC R&D centers in high-technology industries. In such industries adaptive R&D can be sophisticated as with Chinese speech recognition software in which Motorola, Microsoft and Apple have all invested quite heavily. But the level of this investment must not be exaggerated. To get a sense of proportion, Motorola has the highest number of centers in China, yet its investment in China is only about 3% of its global R&D investment. On the Chinese side, Li Yanhua reports of current debates about the benefits of foreign R&D.23 But Ernst (2008) considers that while some quite large successful ITC firms such as ZTE, Huawei and Lenovo have emerged, they are still very small by global standards and that the real challenge facing the Chinese ICT sector is that of improving its integration into global networks. In my view, it would be important to set the Chinese situation in the framework of the “low-hanging fruit” it can still pick broadened to include the acquisition/appropriation of foreign technology.

The effects of financialization as distinct from those of globalization, with its specific opportunities and constraints, are observable in offshoring and outsourcing strategies with technological dimensions adopted by “New Economy” firms. Strategies bearing the mark of shareholder value maximization have been studied by two complementary approaches, one focusing, as in the case of Lazonick mainly on the structural factors behind the decline in US investment and only on innovation in a very broad manner [Lazonick (2012a; 2012b)] and the other more specifically on collective innovative capacity as that of Pisano and Shih. Shareholder value maximization corporate behavior helps to understand the otherwise totally self-defeating US original equipment manufacturer (OEM) corporate strategies of outsourcing to Asian firms. These have been studied by Pisano and Shih in the personal computer industry. US corporations among which Microsoft began simply by outsourcing the assembly of printed circuit boards in the 1980s to contractors in South Korea, Taiwan, and China. Then product assembly began before reaching complete product assembly. Given that many of the components were also sourced from Asia, a logical next step was to take over the management of the supply chain from their American customers. Finally, there came design-engineering tasks. The outcome is that by 2009 “nearly every US brand of notebook computer, except Apple, is designed in Asia, and the same is true for most cell phones and many other handheld electronic devices” [Pisano and Shih (2009)].

The 2005 Joint Academies Report deplores outsourcing but considers that nothing can be done about it:

US companies that outsource information-technology jobs have all but ordered their contractors to send some portion of the work overseas to gain hiring flexibility, cut employment costs − by 40% in some cases ‒ and cut overhead costs for the home company. Offshoring has become established, however, and it is merely one logical outcome of a flatter world. Furthermore, protectionist measures have historically proved counterproductive [National Academy of Sciences; National Academy of Engineering; Institute of Medicine (2005, p. 27-28)].

The strong propensity of “New Economy Firms” to embrace the tenet of shareholder value maximization is also clear in the offshoring of software services and more importantly of software-development to India. In the software industry the development process starts with the identification of a need, followed by the creation of a requirements definition, relating this definition to a software specification, designing the software, writing and coding, and then implementing and testing it [Davies (2004)]. Initially, US firms only outsourced code-writing projects to Indian firms so as to lower their development costs. Over time Indian companies developed their own software-engineering capabilities, won more complex work, like developing architectural specifications and writing sophisticated firmware and device drivers. They are now seen by US analysts as having a very central position in the world software program-writing industry. They have a very number of CMM Level 5 certified companies,24 several Indian IT services companies (TCS, Infosys and Wipro) are listed on the NYSE and NASDAQ and have acquired small US firms. They account for substantial part of US job creation in the industry. More importantly, from the standpoint of the theory of the industrial commons, it is in Indian cities, Bangalore, Chennai, Delhi, Hyderabad, Mumbai and Pune that the virtuous innovation-friendly interactions and feedback mechanisms are at work. As put in a Congressional testimony,

there is considerable evidence that R&D activities generate positive spillovers and that these spillovers are geographically limited in scope. For example, there is evidence that offshored R&D spurs domestic companies in the receiving nations to increase their R&D, thereby increasing the competitive challenge to US firms. This is one of the reasons for the renewed interest around the world in regional ‘clusters’ of economic activity, particularly innovation-based economic activity. As a result, losing R&D means more than the loss of the actual R&D activities [Atkinson (2007, p. 8)].

In the same testimony, it is reported that the “R&D outsourcing model,” if it can be called that, is contagious:

It’s not just large multinational firms that are offshoring R&D; small and midsized technology firms are as well. One study of California-based technology firms (80 percent of which had less than 500 employees) found that R&D was actually the most common activity offshored, with around 60 percent of firms reporting that they offshore R&D, which is about twice the rate of manufacturing offshoring and three times the rate of back office offshoring (p. 8).

A Swedish study focused notably on the future of Silicon Valley and the Bay Area in San Francisco made the same finding. This is not done just by well-established firms but even by recently-started ones still owned by financial investors: “another important driving force is venture capital firms encouraging their portfolio companies to consider locating part of their business activities abroad in order to cut costs” [Franchi (2006, p. 201)]. Here we have the imperatives of “pure financial capital” in their starkest form.

8. Conclusion

The US still has the strongest R&D base in the world. It enjoys clear leadership in military technologies, and Google, Apple and Microsoft have a near to total global control of information flows. But, behind this situation, which is of course more than a mere façade, the work done by lucid US researchers raise important issues, related notably to the effects of financialization which are often overlooked elsewhere in the world. The faltering rate of innovation challenges quite radically the whole idea of economic growth as understood in mainstream economic thinking, namely growth based on an unlimited expansion of private needs in the form of goods and an unlimited availability of natural resources. The word “plateau” seems to be used increasingly. In its latest 2013 report, the McKinsey Global Institute expresses its concern that “although global financial assets have surpassed their pre-crisis totals, growth has hit a plateau. Their annual growth was 7.9 percent from 1990 to 2007, but that has slowed to an anemic 1.9 percent since the crisis.” The authors are alarmed that global financial assets after having increased from 120 percent in 1980 to 355 percent of global GDP in 2007 fell by 43 percentage points relative to GDP since the start of the crisis. They are even more concerned that their indicators of financial globalization (flows of loans, cross-border holdings of bonds and equity, foreign direct investment) reveal a certain degree of “retreat from globalization.” This “retreat” could represent an opportunity and a challenge for countries over the world to direct their technological development in new directions on condition of course that they seek to free themselves as far as possible from the domination of the financial investor.

Referências Bibliográficas

ATKINSON, R. (2007) The globalization of R&D and innovation: how do companies choose where to build R&D facilities? , Testimony before the Committee on Science and Technology Subcommittee on Technology and Innovation, U.S. House of Representatives, Oct. 4, 2007. Available at:

BALL, B. (2010) Bursting the Genomics bubble. , Nature, March 31st, 2010. Available at:

CHESNAIS, F. (2006) The special position of the United States in the finance-led regime: how exportable is the US venture capital industry?, In: CORIAT, B.; PETIT, P.; SCHMÉDER, G. (Eds.). The Hardship of Nations. Northampton: Edward Elgar,

CHESNAIS, F.; SAUVIAT, C. (2003) The financing of innovation-related investment in the contemporary global finance-dominated accumulation regime. , Paper presented in Rio, in 2000, and published in LASTRES, H.; CASSIOLATO, J.; MACIEL, M. L. (Eds.). Systems of innovation and development, evidence from Brazil. Northampton: Edward Elgar,

COWEN, T. (2011) The great stagnation: How America ate all the low-hanging fruit of modern history, got sick, and will (eventually) feel better. , First published in January 2011 as an electronic book. New York: Dutton Editors,

DASGUPTA, P.; DAVID, P. (1988) Priority, secrets, patents and the socio-economics of science and technology, Paper n°127. Stanford: Stanford University, Centre for Economic Policy Research,

DAVIES, P. (2004) What’s this India business? Offshoring, outsourcing and the global services revolution. , Nicholas Brealey Publishing,

DEEG, R.; O’SULLIVAN, M. (2009) The political economy of global finance. , World Politics, 61, p. 4, Oct.

DERTOUZOS, M.; LESTER, R.; SOLOW, R. (Eds.), (1989) .), Made in America. Report of the MIT Commission on Industrial Productivity. , Cambridge: MIT Press,

EPSTEIN, G. A. (2005) Introduction. , In: ______. (Ed.), Financialization and the world economy. Northampton: Edward Elgar Press,

ERNST, D. (2008) Can Chinese IT firms develop inovative capabilities within global knowledge networks? , In: HANCOCK, M. G.; ROWEN, H. S.; MILLER, W. F. (Eds.). Greater China’s Quest for Innovation. Shorenstein Asia Pacific Research Center and Brookings Institution Press,

ERNST, D. (2009) A new geography of knowledge in the electronic industries? Asia’s role in global innovation networks, Policy Study 54, East-West Center, 2009. Available at:

FLORIDA, R. (1999) The role of the university: leveraging talent, not technology. , Issues in Science and Technology, Summer,

FRANCHI, H. J. (2006) Silicon Valley: the global R&D Hub?, In: KARLSSON, M. (Ed.). The internationalization of corporate R&D. Ostersund: Swedish Institute for Growth Policy Studies,

FREEMAN, C. (2003) A hard landing for the ‘New Economy’? Information Technology and the United States National System of Innovation. , Paper presented in Rio in 2000 and published in: LASTRES, H.; CASSIOLATO, J. E.; MACIEL, M. L. (Eds.). Systems of Innovation and Development, Evidence from Brazil. Northampton: Edward Elgar,

GORDON, R. J. (2000) Interpreting the "one big wave" in US long-term productivity growth. , National Bureau of Economic Research, Working Paper 7752, 2000, Washington D.C. Available at:

GORDON, R. J. (2012) Is US growth over? Faltering innovation confronts the six headwinds., National Bureau of Economic Research, Working Paper 18315, 2012. Available at:

LAZONICK, W. (2012) Impatient capital in the US economy. , Presentation at the final meeting of the Finance, Innovation and Growth (FINNOV) project of the European Commission. London: Feb. 2, 2012a.

LAZONICK, W. (2012) The financialization of the U.S. Corporation: what has been lost, and how it can be regained. , In: CONFERENCE ON THE GOVERNANCE OF A COMPLEX WORLD, UNIVERSITY OF NICE SOPHIA ANTIPOLIS, Nov. 2, 2012b. Available at:

LAZONICK, W.; TULUM, O. (2011) US Biopharmaceutical finance and the sustainability of the Biotech boom, , Center for Industrial Competitiveness. Research Policy n° 40. University of Massachusetts Lowell,

LUNDIN, N.; SERGER, S. S. (2007) Globalization of R&D and China: empirical observations and policy implications. , IFN Working Paper No. 710, 2007. Available at:

MCKINSEY GLOBAL INSTITUTE. (2011) Mapping global capital markets 2011. , Aug.

MCKINSEY GLOBAL INSTITUTE. (2013) Financial globalization, retreat or reset? , Feb.

MIROWSKI, P. (2011) SCIENCE-MART: Privatizing American Science. , Harvard University Press,

NATIONAL ACADEMY OF SCIENCES; NATIONAL ACADEMY OF ENGINEERING; INSTITUTE OF MEDICINE. (2005) Rising above the Gathering Storm: energizing and employing America for a brighter economic future. , Washington, D.C., 2005. Available at:

NATIONAL SCIENCE FOUNDATION. (2012) Science and Engineering Statistics. , Washington D.C. 2004, 2012.

NELSON, R. (2004) The market economy and the scientific commons. , Research Policy n° 33,

O’SULLIVAN, M.; LAZONICK, W. (2000) Maximizing shareholder value: a new ideology for corporate governance., Economy & Society, 29, p. 1, Feb.

PALLEY, T. I. (2007) Financialization: What it is and why it matters. , Levy Economics Institute Working Paper, n°525, Dec.

PEREZ, C. (2007) Great surges of development and alternative forms of globalization. , Paper published in Portuguese in: SANTOS, T.; MARTINS, C. E. (Eds.). Long duration and conjuncture in contemporary capitalism, REGGEN-UNESCO/UNU, Universidade Federal de Santa Catarina, 2007. Available at:

PISANO, G. (2006) Can science be a business? , Lessons from Biotech, Harvard Business Review, Oct.

PISANO, G.; SHIH, W. (2009) Restoring American competitiveness. , Harvard Business Review, Boston, Jul.-Aug. 2009. Available at:

PISANO, G.; SHIH, W. (2012) Producing prosperity: why america needs a manufacturing renaissance. , Boston: Harvard Business School Press,

PRESS, E; WASHBURN, J. (2000) The Kept University. , The Atlantic Monthly, March,

SCHACHT, W. H. (2009) The Bayh-Dole Act: selected issues in patent policy and the commercialization of technology, Congressional Research Service, 7-5700, Dec. 3,

SILVERTHORNE, S. (2006) Science business: what happened to Biotech? Questions and answers with Gary Pisano., Working Knowledge Weekly, Harvard Business School, November 13, 2006. Available at:

UNCTAD - UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT. (2005) World Investment Report 2005, Geneva,

UNCTAD - UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT. (2011) World Investment Report 2011., Geneva,

US DEPARTMENT OF COMMERCE (2012) The competitiveness and innovative capacity of the United States, , Washington, D.C. January 2012. Available at:

YANHUA, L. (s.d.) The role of transnational corporations in the National Innovation Systems: The case of China. , In: CASSIOLATO, J. et al. (Eds.), Transnational Corporations and Local Innovation, V. 4, in the series,

BRICS (2013) BRICS National Systems of Innovation, India: Routledge,

Artigos relacionados

In: Encontro Nacional da Indústria, 1984

A Política Tecnológica da Segunda Metade dos Anos Oitenta

Estratégias de desenvolvimento, política industrial e inovação: ensaios em memória de Fabio Erber, 2014

Um economista do desenvolvimento

Estratégias de desenvolvimento, política industrial e inovação: ensaios em memória de Fabio Erber, 2014