Macro and micro issues related to natural resource-based economic growth

Jorge Katz, Estratégias de desenvolvimento, política industrial e inovação: ensaios em memória de Fabio Erber / Organizadores: Dulce Monteiro Filha, Luiz Carlos Delorme Prado, Helena M. M. Lastres. – Rio de Janeiro : BNDES, 2014. A first version of the present paper was writen while the author was holding a visiting fellowship at the Latin-American Centre (LAC) of St. Antony’s College, in Oxford. Support for such visit was received from LAC and from the Corporacion Andina de Fomento (CAF) and it is hereby kindly acknowledged. The usual caveats apply.

Fabio’s way of looking at Economics was strongly shaped by the way in which he understood macro-to-micro interactions and the political economy of the world of manufacturing. This paper examines some of these topics which I would have certainly enjoyed discussing with him. Natural resource based growth resulting from expanding exports of industrial commodities has been the subject of heated debate among economists. While some of them consider such strategy a "curse" due to the fact that it makes the economy more exposed to the volatility of world prices for raw materials and therefore more exposed to externally induced turbulence, others point out to the fact that natural resource processing industries provide a valuable road for the introduction of new technologies opening up a "window of opportunity" for skill intensive activities in biotechnologies, machinery and equipment, logistics and more. Macro and microeconomic consequences result from expanding exports of natural resource based commodities. Specialized literature has examined said consequences under such exotic names as the "Dutch Disease" syndrome and the "Tragedy of the Commons". Propelled by the rapid expansion of Chinese demand for the industrial commodities, many countries in Latin America have attained significant growth over the past decade. Argentina, Brazil and Chile constitute three major examples whose comparison is undertaken in this paper.

1. Fabio

Lifelong consistency with one’s own ideals and values is probably one of the more important – and harder to achieve – qualities human beings can have. This is exactly how I come to think of Fabio, as a warm, consistent person, capable of maintaining over his lifetime his ideals for a better world, for a more egalitarian Brazil. He thought of Economics as providing a tool box to help us achieve just that, a more humane model of economic development capable of simultaneously delivering growth and equity. Over the years, as many of us did, he grew increasingly annoyed by the fact that it was not just a matter of good research and analytical thinking but a more difficult political economy puzzle most countries in the world just cannot come around easily to solve. He never claudicated to the formalities and established conventions of the profession and maintained to the last moment his eclectic way of looking at things, bluntly putting his views to his audience without expecting applause. This is the way I remember him, as an honest, profound and hard-working colleague. This paper is dedicated to his memory, to the wonderful person he was, and to the many good moments we spent together.

Fabio’s way of looking at economics was strongly shaped by the way in which he understood macro-to-micro interactions and the political economy of the world of manufacturing. When development is based upon the exploitation of natural resources many new questions come to the fore which specialized literature explores under such exotic names as the “Dutch Disease” or the “Tragedy of the Commons”. Here is a paper examining some of these topics which I would have certainly enjoyed discussing with Fabio.

The impact of growing on the basis of natural resources has engaged economists for many years now and from various different perspectives. J. Sachs and A. Warner were among the first to argue that the availability of rich natural resources might turn up to be a “curse” that could retard the process of economic growth. According to these authors it makes the economy more strongly to depend upon the volatility of world prices for raw materials and therefore more prone to externally induced turbulence. It favors the appreciation of the local exchange rate, triggering recurrent episodes of the so called Dutch Disease. It retards the evolution of the local production structure into more knowledge intensive activities due to the significant productivity differentials which prevail between natural resource processing industries, on the one hand, and engineering intensive sectors on the other. Furthermore, natural resource processing industries are normally highly capital intensive and should not be expected to create much employment. Many of these ideas are at the basis of the thinking of authors such as R. Prebisch and H. H. Inger and provided the foundation for a large body of literature emerging from ECLAC, the Economic Commission for Latin America and the Caribbean of the United Nations, that worried about falling terms of trade and also about the benefits of technical progress in primary production being transferred from the periphery to the center.

On the other hand, and inspired by the experience of countries such as Finland, Sweeden or Denmark, other scholars have pointed out to the fact that natural resource processing industries provide a suitable route for the introduction of sophisticated process technologies upstream and downstream of the resource itself, opening many “windows of opportunity” for the expansion of skill intensive activities in intermediate inputs and services [Lundvall (2004)]. Biotechnologies, digitalized process control equipment, agrochemicals, vaccines, and more belong in this set of skill intensive activities that might develop in association with the expansion of natural resource processing sectors. Recent research in Latin America provides support to this argument showing that significant advances have been attained by Argentina, Brazil, Uruguay and other countries in biotechnologies, genetics – animal cloning, genetically mod Macro and micro issues related to natural resource-based economic growth Jorge Katz 175 ified (GM) seeds, and more – opening up new “windows of opportunities” for the future [Bisang (2007)].

Beyond “blessing” or “curse”, other topics need be mentioned which have not so far received much attention in the literature concerned with natural resources [Katz & Iizuka (2011)]. The first one has to do with the relationship between natural resources and environmental sustainability. The second one refers to the fact that natural resources frequently belong in the category of “commons” where the risk of over-exploitation – as discussed by G. Hardin in his famous parable of the “Tragedy of the Commons” [Hardin (1968)] constitutes a likely possibility. Finally, it is importante also to notice that recent advances in genetics and biology, in immunology and health sciences and in the understanding how DNA recombination works, is opening a new way of looking at natural resources which Latin-American countries should certainly explore in the years to come.

The second section of this paper looks at new macro questions resulting from the growing specialization in Latin American countries exhibit in industries and activities related to the exploitation of natural resources. The third section deals with many micro questions of industrial organization and environmental sustainability related to a rapidly expanding rate of exploitation of the region’s natural resources.

2. The Dutch disease syndrome and other macro issues related to natural resource based growth in Latin America

The past decade has witnessed inflation targeting macroeconomic policy regimes being adopted by many countries in Latin America, as well as their corollary: floating exchange rates. Chile, Brazil, Mexico, Colombia and Peru can be seen as examples of this policy option while Argentina opted instead for a managed exchange rate regime after abandoning the dollarization of the economy in 2001. We can ask ourselves how have these two macroeconomic policy regimes performed in terms of growth, exports, employment and international competitiveness.

Frenkel and Fanelli (1996) compared the trade liberalization experience of Brazil and Argentina in the 1990s. Both countries had very similar conditions, except for the fact that the Brazilian Real was undervalued and stable, while the Argentine Peso was overvalued and appreciating. Brazilian exports grew fast while Argentine exports remained stagnant. Exactly the opposite happened more recently, and the outcome has been quite similar: Argentinean manufacturing exports grew fast between 2003 and 2008 while Brazilian manufacturing exports lost ground in world markets as a consequence of currency appreciation [Albrieu (2011)]. Looking at a broader sample of cases, Frenkel and Rapetti (2010) conclude that the real exchange rate (RER) “has had a significant influence on the macroeconomic performance of Latin American countries.”

Thus, received literature shows that RER affects the growth performance of the economy, also having a significant impact upon the evolving structure of Gross Domestic Product (GDP) and exports. If we follow the reasoning into the micro, we might also notice that RER affects new company entry and innovation efforts leading to expanding into foreign markets.

On the other hand, overvaluation of the local currency has the reverse effect. Furthermore, if the appreciation of the local currency persists for some time, it might even have an irreversible negative impact upon the structure of the economy as well as upon international competitiveness, as investment in new production capacity and in innovation might be postponed or be biased against knowledge intensive sectors.

Open economies macroeconomic management confronts us with the so called “trilema” or “impossible trinity” as Nassif, Feijó and Araújo (2011) Macro and micro issues related to natural resource-based economic growth Jorge Katz 177 have called the difficulty governments face to choose between different degrees of autonomy in monetary policy, foreign exchange intervention and capital mobility. The logic of the Mundell Fleming model indicates that the choice of the exchange rate regime affects the way in which domestic prices and the balance of payments are maintained in equilibrium. As Nassif, Feijó and Araújo (2011) argue:

In an ideal world with free capital mobility it is assumed that a floating exchange rate regime can absorb external shocks without affecting the level of international reserves making the country less vulnerable to exchange rate crisis and speculative attacks (p. 8).

With an open capital account and a floating exchange rate regime, the authorities can stabilize the domestic price level through monetary policy acting upon the interest rate and aggregate demand, but cannot simultaneously have under control the exchange rate. If RER appreciates, it might end up affecting the structure of the economy by diminishing the relative competitiveness of more knowledge intensive activities which we can assume to be located further away from the international productivity frontier.

The perception that the appreciation of the real exchange rate might have a stronger negative impact upon industries which lag further behind the international productivity frontier turning them less competitive in world markets induced Luiz Carlos Bresser Pereira, Fabio Erber, E. Pacheco and other Brazilian economists to consider the possibility of multiple equilibria for RER if public policy regards the catch up with the international frontier as a major national objective. Fabio Erber strongly argued that an adequate RER could facilitate the economy to attain faster growth and that industrial policies should simultaneously be used to induce the catch up with the frontier in more knowledge intensive activities [Pereira (2010); Erber (2011)].

A different way of putting the case would be argued that a SCRER – stable and constant real exchange rate – might not be a strong enough policy intervention to induce firms in more knowledge intensive activities – which lag further behind the international technological frontier – to undertake innovative efforts, and absorb the uncertainties, associated with catching up with the international state of the art. If this were the case, the government can resort to sector-specific instruments – i.e. to an industrial policy – to induce catching up with the frontier in knowledge-intensive activities. The history of the Korean or Taiwanese “catch up” can be seen under such light [Rasiah (2007)]. Sector specific subsidies and incentives were used in addition to a SCRER to induce firms to undertake “abnormally” risky and uncertain investment and innovation decisions [Lee (2011)]. Latin American governments have been reluctant to adopt this view during the past decades due to ideological limitations imposed by Washington Consensus thinking and have instead resorted to “neutral” price incentives such as tax reductions on R&D expenditure or grants for human capital upgrading. Unfortunately there is little evidence suggesting that neutral interventions have been successful inducing Latin American firms entering into more knowledge intensive activities.

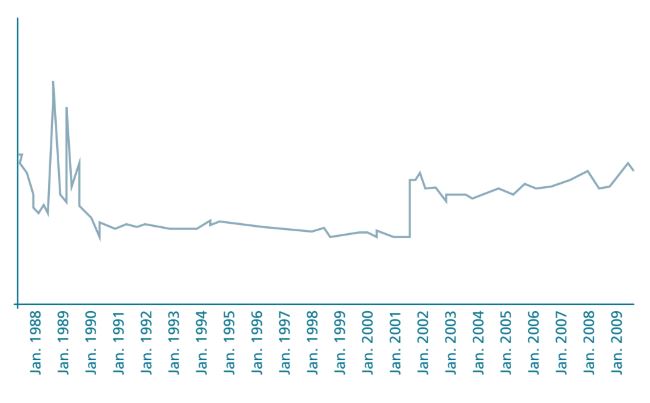

At this point of the argument we should perhaps notice that for well over a decade now natural resource-based commodity prices have been experimenting a steady upward trend in world markets. The trend is stronger in gas and petroleum, followed next by minerals and lastly by grains and foodstuffs [Jenkins (2011)]. Although the upward trend was negatively affected in 2009 by the international financial crisis, it returned thereafter, as Figure 1 shows. Associated to this upward trend in commodity prices, terms of trade have improved and foreign exchange reserves accumulated in Argentina, Brazil, Chile, Colombia, Peru, Uruguay, Bolivia and Paraguay.

Figure 1: Commodity prices and the Dutch Disease syndrome

During the “inward-oriented” period of growth – in the immediate post-war years – Latin American governments intervened in episodes of this sort neutralizing the domestic impact of increasing commodity prices by augmenting taxes on primary exports, and also using special incentives for non-traditional exports or multiple exchange rates. Said instruments of direct intervention have been phased out in the current orthodox stage of macroeconomic management, leaving the external sector of the economy solely to depend upon fiscal, monetary and exchange rate policies. This is where the “Trilema” or the “impossible trinity” enters the current Latin American debate. Most countries opted for an inflation targeting regime, aiming at keeping inflation at bay and, simultaneously, maintaining an open capital account searching for international credibility and for the approval of risk rating agencies. This involved accepting a floating exchange rate as part of the macroeconomic policy regime. A critical Fabio Erber can be remembered as negatively reflecting upon this macropolicy regime in recurrent opportunities.

Consider now the case of Argentina which opted for a different course of action. After devaluating its currency, Argentina adopted a fixed rate regime looking for more degrees of freedom in monetary and fiscal policy. How have these two regimes performed during the past decade? In looking at this question we now make use of the results we obtained in a joint research carried out with Gonzalo Bernat from the University of Buenos Aires, and published in the International Journal of Institutions and Economies [Katz & Bernat (2011)].

After leaving the Currency Board Regime in 2001 Argentina opted for a SCRER which induced the expansion of GDP, exports and employment as well as the accumulation of foreign reserves.

Figure 2: Evolution of the exchange rate in Argentina

At variance with the case of Argentina, Brazil and Chile allowed their currency to float. Both currencies appreciated, strongly in the case of Brazil and somewhat less in the case of Chile, as we notice in Figure 3.

Figure 3: Argentina, Brazil and Chile, alternative regimes of macroeconomic management

The observed differences in exchange rate management had importante consequences for the global functioning of these three economies.

Manufacturing exports increased faster in Argentina than in Brazil and Chile. The accumulated growth of exports between 2003 and 2010 was higher in Argentina (59.4%) than in Brazil (34.6%) and in Chile (25.4%) [Katz & Bernat (2011)]. In line with expectations concerning the impact of the Dutch Disease syndrome, both Brazil and Chile show negative export figures in 2007-2010 – 4.9% and 5.8% respectively – while Argentina maintained a 15.4% growth rate over the same period.

The falling competitiveness of Brazilian and Chilean exports and the displacement of domestically-produced goods by imported substitutes affected the growth performance of industry. In effect, manufacturing industry posted an 8.1% annual growth rate in Argentina between 2004 and 2008, while manufacturing in both Brazil and Chile expanded 3.8% over the same period. Only a few medium tech sectors – like the vehicle industry – expanded fast in Brazil, while much of manufacturing production remained stagnant. Low tech sectors such as shoes and garment, previously quite significant in Brazilian exports, could not resist the simultaneous impact of the appreciation of the real exchange rate and the irruption of Chinese competition in world markets, and significantly reduced exports [Katz & Bernat (2011)].1

On the other hand, it is important to notice that the GDP growth bonanza 2002-2008 did not induce Argentine entrepreneurs into a more pro-active investment and innovation behavior – neither did the government try to coach firms in that direction through explicit industrial policies – which would have involved using the increase in unit gross margins they were receiving after the devaluation, for the construction of more modern and internationally competitive production facilities. In this sense it can be said that a SCRER was not enough to induce Argentine firms into stronger technological efforts which might have allowed them somewhat to close the gap with the international productivity frontier. Neither did the government resort to a more pro-active industrial policy of the type used by Korea in the 1980’s, aiming at developing more knowledge intensive sectors in the economy.

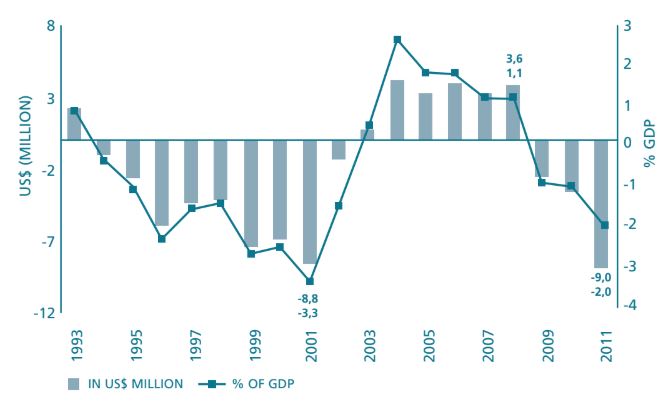

The 2008-2009 international financial crisis affected Argentine external balance, as can be seen in Figure 4. This forced the government to call for Central Bank financing of the (still expanding) fiscal expenditure and the service of the external debt. In other words, the government resorted to the inflationary tax to cover the negative evolution of the external sector of the economy, trying not to lose international reserves. This involved the abandoning of the SCRER regime which had induced the rapid expansion of GDP, employment and exports between 2002 and 2008.

After abandoning the SCRER regime, Argentina returned to the traditional foreign exchange constraint that characterized its “inward-oriented” industrialization model in the immediate post war era. The appreciation of the real exchange became significant in 2011 and thereafter [Castineira (2012)].

Figure 4: The deteriorating =nancial position of Argentina 2008-2011

Brazil and Chile on the other hand suffered of the Dutch Disease syndrome with varying degree of intensity. They both saw their competitiveness in manufacturing eroding rapidly, and the industrial sector losing share in GDP, while non-tradable activities gained participation. World prices and Chinese demand for copper, iron and steel, pulp and paper, soybean oil and more remained high, but signs of an increasing “commoditization” of their export mix became evident. Imports of capital goods expanded fast favoring an increasingly negative trade balance. Although both countries succeeded in keeping inflation at bay, they could not avoid the appreciation of their currency affecting the structure of the economy in the 2000s, with manufacturing losing ground within aggregate GDP and external competitiveness being increasingly concentrated in natural resource based commodities.

3. The evidence so far presented permits us to draw some conclusions

The SCRER regime permitted Argentina to attain rapid GDP growth between 2002 and 2008. The industrial sector recovered dynamism and participation in GDP, induced both by the expansion of domestic aggregate demand and by exports. Employment grew quite fast with around four million new jobs being created during this period. Although the effect could be felt across manufacturing activities it was particularly strong in vehicles, textile, pharmaceutical and foodstuffs, i.e. industries of low and medium high technological sophistication. The expansion was not associated, however, with investment in new and more modern production facilities which would have permitted Argentina gradually to close the gap with the international productivity frontier. Rather, “old” plants – 1980 vintage – were revitalized after the currency devaluation to take advantage of the expanding domestic market and also increasing exports. So, even in the context of a SCRER and of an expanding domestic economy, Argentine entrepreneurs did not respond by proceeding into more technology intensive activities, bringing on board more innovation, R&D and knowledge generation efforts. They opted instead for maintaining under operation their old production facilities, marginally upgrading them through capital goods imports. Neither did the government resort to an industrial policy inducing firms to explore the option of faster technological modernization and of variety creation – new sectors of economic activity – as we saw happening in numerous occasions in some of the Asian economies in the 1980s [Kim (1997)]. As the economy expanded faster capital goods imports increased more than proportionally becoming a heavy burden upon the external trade balance. Even sectors that responded well in terms of increasing exports – such as automobiles and pharmaceuticals – exhibit an increasingly negative external balance. The loss of foreign reserves resulting from the 2009 international financial crisis – see Figure 4 – brought the SCRER regime to an end forcing the government to accept an inflationary tax to cover its increasingly weak financial position. Lacking a more adequate set of monetary and fiscal anti cyclical policies and also lacking a pro-active industrial policy fostering innovation, variety creation, productivity growth and “technological deepening,” Argentina saw the 2002-2008 bonanza pass by without much benefiting from it.

On the other hand, the appreciation of the exchange rate resulted in a decaying manufacturing performance in Chile and in Brazil, favoring the increasing “commoditization” of exports and the expansion of non-tradable activities. Lacking adequate anticyclical monetary and fiscal policies and also a pro-active industrial policy inducing innovation and technological deepening, the two countries ended up negatively affecting the long term technological deepness of the economy.

We can conclude the present section by arguing that natural resource-based growth demands not only adequate anticyclical monetary and fiscal policies, but also sector specific industrial policies inducing innovation and productivity growth and the creation of domestic technological capabilities, if GDP growth is to be accompanied by structural change, innovation and technological deepening in the economy. None of the three countries hereby examined adequately combined macro and micro interventions favoring innovation, variety creation and the closing up of the international productivity gap.2

Adequate macro management – i.e. keeping inflation at bay – appears as a necessary but not sufficient condition for conducting the economy into a growth path of increasing technological sophistication and of better inception in world markets [Ocampo (2011)]. A SCRER and sector-specific industrial policies are needed if the technological gap is to be reduced. I am pretty sure this conclusion would not have much surprised Fabio’s eclectic views on issues of innovation and catch up policies. It is somewhat reassuring to feel that way.

4. Natural resource based growth and the “tragedy of the commons”

Our previous section has looked at macroeconomic aspects associated to natural resource based growth. In this section we examine sector-specific and micro issues associated to such growth strategy.

Natural resource based industries are different from manufacturing activities primarily because many of them intensively use inputs which have a certain amount of “publicness.” Natural resource based industries affect long term environmental sustainability, biodiversity, soil fertility and erosion, climate, “greenhouse” effects, and more. This opens up new industrial organization and sectoral governance policy issues which are far less important in conventional manufacturing spheres. When two aquaculture firms cultivate salmon in the same coastal area they both share on the use of the same water. There is no way of stopping the “horizontal transmission” of vectors and pathogens among them. Public Sector regulation and “collective action” for the protection of the sanitary and environmental sustainability of the resource becomes a major feature of market governance in cases of this sort. Profit maximizing firms as those found in price theory books just do not take these effects into account. When genetically modified soybean is produced in any given region there is no way of stopping biodiversity to be negatively affected in that region, let alone the decline in soil fertility and the increase in soil erosion. World market prices for soybean do not pay for this depletion effect. Irrigation water, biodiversity, environmental services, climate change, soil erosion and fertility, share an element of “publicness” which market prices do not reflect well and which influence the behavior of economic agents when trying to maximize private benefits. These market scenarios are more difficult to discipline than conventional markets given the above mentioned publicness of the natural resource being used. Profit maximizing firms can be expected to develop a natural tendency to overexploit the “common” and received literature has extensively explored regulatory aspects and “collective action” arrangements substituting for the disciplinary role of markets. In our next section we illustrate some of the emerging new issues by looking at salmon farming in Chile and soybean production in Argentina.

4.1 Case studies on salmon farming and soybean production

4.1.1 Salmon farming in Chile

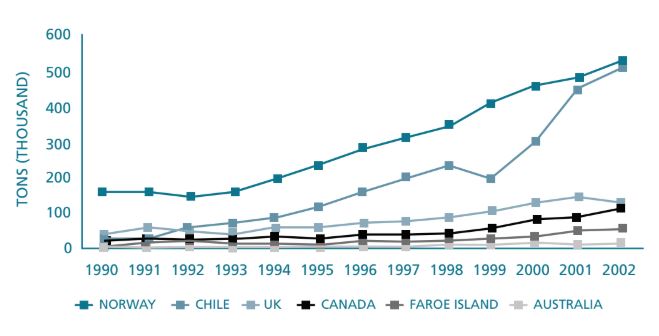

Salmon is an exotic species in Chile. It was incepted locally late in the 1970s and early 1980s through a Public Sector program conducted by Fundación Chile – a public/private R&D and knowledge-generation agency – in close collaboration with various US and Canadian academic institutions, and Japan International Cooperation Agency (JICA), from Japan. The industry attained rapid expansion throughout the 1990s, but it is only in the 2000s that it closed the gap with the international leader in salmon farming – Norway – producing close to 700.000 tons annually, i.e. one third of total world output of cultivated salmon. Figure 5 provides evidence to this effect.

Figure 5: Chilean catching up in volumen of salmon output

Salmon farming started in Chile mostly as an industry of domestic small and medium enterprises (SME), which gradually developed significant local production and technological capabilities through learning by doing, accumulating tacit knowledge in many areas such as the construction of cultivation tanks, net cleaning and disposal of mortalities, vaccination and more. Foreign capital only entered the industry in a big way one decade later, when much of the uncertainties surrounding the likelihood of Chile becoming an important producer and exporter of cultivated salmon had been eliminated by timely intervention of Fundacion Chile. By 2007, Chile was producing roughly the same volume of output as Norway, but it was doing it in a coastal area which was four times smaller than the coastal area employed by the Scandinavian country. This involved much higher degree of proximity among cultivation centers, and bigger cultivation tanks than in Norway [Katz & Iizuka (2011)]. The much higher degree of geographical concentration resulted from the lack of social infrastructure – schools, health centers, telecommunication services and more – in Chile, which forced salmon farmers to establish their production facilities closer to more populated areas admitting the cost of being closer to one another, and also sharing on the use of docks and coastal space with the tourist industry, artisanal fishermen and more. This facilitated the “horizontal transmission” of germs and pathogens, which became a critical issue as output expanded. It finally turned into a crisis in 2008 with the diffusion of ISA, a viral disease which kills salmons affecting their auto-immune response, although it does not affect human beings. The rapid expansion of output in a very small coastal area and high fish density in the cultivation tanks – induced by high world prices for salmon which were obtained as a consequence of the avian flu in Europe – explain the diffusion of new diseases throughout the 2000s which we notice in Figure 6.

Figure 6: The response of the environment

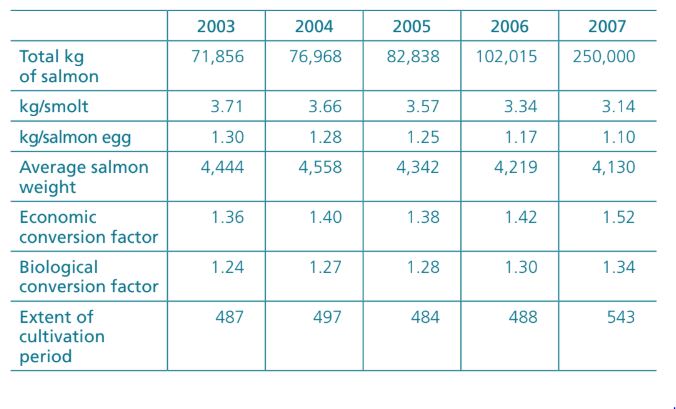

The increasing deterioration of the common helps to explain the downfall of various biological and economic productivity indicators, as reflected in Table 1.

By 2009, and after the outburst of ISA in 2008, industry output had fallen to about one half of the volume attained in 2007, with close to 60% of the cultivation tanks being out of production. Millions of fish had to be slaughtered, exports contracted sharply to around one half of the value attained in 2007, and some 25 thousand workers lost their jobs as a result of the sanitary and environmental crisis. Many villages in Southern Chile, in which 90% or more of the population was employed by the salmon industry, found their social and economic life deeply disrupted, with most of the population out of work. The crisis attained systemic nature when the banking sector announced that it was no longer prepared to bail out the industry as its working capital – fish in the cultivation tanks – had evaporated and they no longer were credit worth. The standing debt of the industry with the banking sector approximately reached one year worth of exports [Katz & Iizuka (2011)].

Table 1: Falling biological and economic indicators reflecting mismanagement of the common

What had gone wrong? Neither “collective action” from the part of firms aiming at protecting the sanitary and environmental conditions under which salmon was being produced, nor an adequate regulatory regime involving public sector fiscalization of firm behavior developed during the years of rapid industrial expansion. Nothing succeeds more than success, and nobody thought it fit to fiscalize an industry which was growing at two digit rates for well over a decade. Very few people understood at that time that the industry was running into a crisis of over-exploitation of the “common” much of the sort Hardin described in his 1968 Science paper on the Tragedy of the Commons, where he suggests that situations of this sort might develop when individual profit maximization induces firms to over-exploit the common leading towards the global failure of the industry. In a much celebrated book on the Governing of the Commons, E. Ostrom takes issue with Hardin’s argument showing that in many different societies and through quite different processes, communities that base their subsistence on the exploitation of a “common” often develop different forms of “collective action” addressing the protection of the resource [Ostrom (1990)].

The Chilean salmon farming case illustrates a situation in which nor “collective action” from the part of firms, neither regulatory intervention from the part of government could stop the impending crisis biologists, veterinarians and workers in the cultivation tanks saw coming up for quite some time. It is only economists and company administrators, fascinated with the rapidly expanding cash flow the industry was exhibiting, that failed to understand the magnitude of the impending crisis.

This case illustrates well the fact that it is not just production technologies that matter when it comes to grow on the basis of natural resources. “Social technologies,” i.e. Forms of social organization and intangible “social capital,” are also needed to secure the long term sustainability of the “common” [Nelson (1998); Katz & Iizuka (2011); Ostrom (1990)]. Social technologies and “collective action” are difficult to bring from abroad. They normally involve a long process of trust creation and social interactions which are local and sector-specific. What is the optimal “loading capacity” of the “common,” which are the more appropriate sanitary and environmental protection routines to be followed, how much do I believe my neighbor when he discloses information concerning the rate and sources of fish mortality in his cultivation tanks, and much more, constitute “location-specific” attributes that cannot be imported or answered on the basis of external know-how. In situ R&D and experimental activities are needed, trust and community values need to develop if production and technological capabilities are to grow hand in hand with a sustainable use of the “common” [Katz & Iizuka (2011)]. Again, we confront here the difference between developing production capacity and technological competence, as previously mentioned in the paper.

The 2008 sanitary and environmental crisis had a tremendous impact upon Chilean salmon farming, from which nor the industry neither Public Sector regulatory agencies have yet entirely recovered. Many production organization routines have changed at the individual firm level, as companies try to do things better, but not very much has yet happened in terms of new forms of “collective action” emerging addressing the protection of the common. Moreover, although location-specific’ R&D efforts have increased, the numbers are still minute vis-à-vis what is required. Equally so, the legal and regulatory environment has been strengthened through various new laws and forms of fiscalization3 but it is difficult to conclude that the government has attained a significantly better degree of control over the industry, and that a new cooperative public/private atmosphere has been established. Changes in patterns of social interaction and in production organization take time to be developed and it is by no means obvious that this is taking place at a pace that will successfully bring on board new industry routines and government surveillance practices that could maintain under control the ever changing biological mutation viruses, pathogens and diseases undergo tough time. We face here a peculiar long interaction between the ecology – that expresses itself through the recurrent mutation of viruses and pathogens – and social organization which results in more collective action, trust and better public/private collaboration arrangements. There is nothing to tell us how this long term dialogue is to result in the future of Chilean salmon farming but there is no doubt that better collective action and more regulation are needed if the country is to attain rapid growth and a more sustainable inception in world markets.

4.1.2 Soybean production in Argentina

Throughout the 1990s, Argentine agricultural production underwent a tremendous transformation. The production of grains increased from 26 million tons in 1988-1989 to over 75 million tons in 2002-2003, reaching close to 100 million tons by the end of the decade. Within this global picture the dramatic expansion of genetically modified soybean, i.e., herbicide-tolerant varieties of the grain, constitutes a quiet social, institutional and production organization “revolution” by itself, which deeply affected not just the structure and behavior of the agricultural sector, but also many other macro and micro dimensions of the Argentine economy. In the hip of success – as we saw this happening in the case of Chilean salmon farming – many dimensions related to the environmental and social impact of these new technologies have not yet been adequately explored and evaluated.

In the short period of five years GM soybean reached 90% of total soybean production in the country, making Argentina second to the USA as far as total volume of production of GM soybean is concerned. The area sown with herbicide-tolerant soybean increased from less than 1% of the total area planted in 1996-1997 to well over 90% of the more tan 12 million hectares planted in 2001-2002. Production reached nearly 40 million metric tons. A variety of reasons come together explaining why this “virtuous cycle” of technological “deepening” and social and institutional transformation occurred [Trigo & Cap (2003)].

Access to GM soybean varieties – not based on local research and development efforts, but rather on imported seed brought by multinational corporations (MNCs) which were the first to carry field trials locally, the flexibility Argentine regulatory institutions exhibited permiting new GM varieties to be tried in the national territory (something which did not happened in other countries, Brazil, for example), the concomitant difusion of the no-tillage production model, which facilitates the incorporation of double-cropping soybean in areas where only one crop was planted before the availability of GM seeds, cost reductions resulting from lower energy and labour costs that obtain from more effective weed management, significant reductions in the price of glyphosate – the herbicide used with transgenic soybean varieties –, the fact that farmers could use seeds reproduced in their fields and did not have to pay royalties to access the new varieties (as Argentina signed Agreement 78 of the Protection of New Varieties of Plant Agreement and not UPOV 91 which makes seeds more expensive by granting more market power to the technology owning companies),4 and more, help to explain why GM varieties became so easily accepted by local farmers and diffused so rapidly. They significantly improved farmers’ profits. This also explains two other aspects which need to be taken into consideration. First, lower cost and high unit gross margins associated to GM soybean production induced many farmers to substitute other agricultural activities, such as cattle-raising and dairy production for GM soybean. W. Pangue argues that “soybean production has, in the last five years, displaced 4.6 million hectares of land dedicated to other production systems such as dairy, fruit trees, horticulture, cattle and some grain” [Pangue (2005)]. We should notice that this involves a negative impact upon biodiversity affecting the country’s foodstuff exports. Second, the expansion of production not only induced a more “intensive” agriculture – higher output per hectare – in the Argentine Pampas, where more than 50 million hectares of excellent arable lands are available, but induced farmers to expand into more environmentally sensitive areas such as the rain forest of Yungas or Chaco, where land is somewhat cheaper than in high yield areas of the Pampas. After arguing that the Pampas prairie is not homogeneous in soil, weather or biodiversity, W. Pangue concludes that “it is in these areas (the environmentally more sensitive and less expensive regions of the prairie) that transgenic soybean and cero-tillage agriculture started to spread” [Pangue (2005, p. 315)]. He indicates that an additional 4.5 million hectares have been brought into production in these marginal areas. As more frail areas of the prairie are brought into production increasing problems of soil erosion develop with negative consequences upon climate and desertification.

In addition to the above, the parallel expansion of “contract agriculture” with independent subcontractors taking an increasing share of the annually planted area, also favored the rapid diffusion of the new technology and the gradual transformation of the rural sector in Argentina. Farmers are no longer farmers in the traditional sense. Many of them have turned into rentiers who annually lease their land to subcontracting companies which now manage the whole operation form planting to harvest. These subcontractors are firms combining state of the art knowledge coming from agronomists and engineers and financial might coming from banks. An incredible amount of richness has fallen over the Pampas and the price of land has increased dramatically. Soybean has become synonymous of richness in Argentina, as petroleum once was in Texas.

GM technologies, no tillage production practices and “contract agriculture” help to explain the successful expansion the Argentina economy attained during the past decade. Lower production costs, higher productivity per hectare and a rapidly expanding area planted with GM soybean explain the dramatic success this new technology has had in Argentina.

But, is this more “intensive” agriculture neutral from the point of view of the environment? Consider, in particular, aspects of soil fertility and erosion and of biodiversity. This is a major, and yet unresolved, area of academic controversy. Some authors argue that “the cumulative effects of soil erosion resulting from conventional tillage practices were beginning to negatively affect the operating results of farms” [Trigo & Cap (2003)]. Moving on to zero tillage production practices and herbicide-tolerant soybean involved a positive change in production routines which has reduced – according to these authors – the degree of soil erosion associated to more conventional production methods. Moreover, glyphosate – the herbicide used with GM soybean – has been shown to be environmentally neutral due to the lack of a residual effect, as it rapidly degrades in the soil. So, this also represents, according to the above mentioned authors, an important advantage particularly when compared with atrazine, the herbicide that was mostly used before, that has residual effects and negatively affects the environment. Gliphoside has substituted atrazine, this being a further advantage of the new technology. Finally, Trigo and Cap argue that zero tillage practices not only have had a significant impact upon the recovery of soil fertility but also have other potentially positive externalities, such as for example the reduction of greenhouse effect. Given all of the above they conclude that the GM technology is environmentally-friendly.

An alternative point of view also exists, arguing that a more intensive agriculture depletes the soil of its natural nutrients and damages the natural recycling of nutrients that it obtains when a conventional crop and cattle rotation production routine is followed by farmers. In this connection ecological economists [Douai et al. (2012)] would argue that Argentina is exporting a considerable amount of soil nutrients – nitrogen, phosphorous and potassium – together with its exported grains, and that such transfer is not being replenished. Speaking as from this perspective Martinez Alier and Oliveras consider that there is an “ecological debt” resulting from soil depletion, which is not being accounted for by market prices [Pangue (2005, p. 317)]. Following such line of reasoning, W. Pangue estimates that “if the natural depletion were compensated with mineral fertilizers, Argentina would need around 1.1 million metric tons of phosphorous fertilizers at a cost of US$ 330 million in the international market” to pay for the depletion of soil fertility [Pangue (2003)]. A decaying quality of Argentine soils, an increasing rate of de-forestation as GM soybean production invades previously forested land, loss of biodiversity and greenhouse effects and climate change are among the negative externalities ecological economists bring to the fore when they evaluate the long termimpact of the rapid diffusion of GM soybean.

Obviously this is an open ended, debate. While the dispute is going on, no one in Argentina would argue for stopping the dramatic expansion of GM soybean production. High world prices for soybean, a rapidly expanding world demand – mostly coming from China and other Asian economies – and an increasing need for foreign currency and fiscal revenue, constitute powerful enough reasons not to expect that the present status quo is to change significantly in the near future. The potentially long term environmental consequences of GM soybean expanding even further are to remain just as long term consequences not many people would be inclined to revise under present circumstances. The obvious intergenerational conflict hereby involved will probably be left for future consideration.

4.2 An overview: what are the main issues?

Having looked at salmon farming in Chile and soybean production in Argentina as examples of production areas in which the intensive use of “commons” opens up new questions related to sanitary and environmental sustainability, to “collective action” aiming at the protection of the “common,” to public sector regulatory capacity, and to inter-generational preferences in the use of environmental services, we can now draw a few conclusions.

Growing on the basis of natural resources brings to the fore important issues related to the use of “commons” which have not yet been adequately researched. What is the equilibrium price for environmental services in commons which are simultaneously being used by different sectors in the economy such as industry, tourism, artisanal fishermen, local original people? How should royalties and “shadow prices” be used to account for the value of environmental services, especially so when market and non-market elements are involved, as in the case of the “common” being the homeland of original people which have lived there since pre-Colonial times? How should we account for the loss of biodiversity, the decay in soil fertility or the increase in greenhouse effects? In many of these areas we still lack knowledge and understanding as to what the impact is of growing on the basis of a more intensive exploitation of natural resources. Moreover, as E. Ostrom pointed out “these resources are embedded in complex social-ecological systems, composed of multiple subsystems in which scientific knowledge is needed, but ecological and social sciences have developed independently and do not combine easily” [Ostrom (2009)]. More research and further involvement of local communities is needed to better understand how to deal with these complex new issues. Biological, health and environmental forces interact in complex ways we still scarcely understand and new forms of dialogue among these disciplines seem to be needed before public policy can be designed and implemented. Conventional market models do not illuminate well many of these issues. Moreover, we know very little as to how to develop collective action and social capital protecting commons and outcome seems to be highly location-specific [Poteete & Ostrom (2004)]. We are also far from having adequate Public Sector strategies to deal with these questions. Said strategies not only demand adequate data and legal norms but also a strong enforcing capacity from the part of public sector agencies which many developing countries normally lack. In spite of the above, it is nonetheless clear that a long-term national strategy is needed if natural resource based growth is to continue as a central element in Latin American future growth.

5. Concluding Remarks

Growing on the basis of natural resources brings to the fore a complex set of new questions which demand urgent examination. Some of these questions belong at the macro level whereas others involve issues of microeconomic and sectoral nature.

Considering first questions of macroeconomic management, we notice that most countries in the region have in recent years opted for inflation targeting regimes, a floating exchange rate and an open capital account. They have done so out of “fear-of-inflation” and of bad risk rating from the part of international financial agents, but that has resulted in currency appreciation, increasing “commoditization” of exports and decay of manufacturing activities, particularly so in the more knowledge intensive segments of the industrial sector.

On the other hand, a SCRER has been shown to induce more rapid growth of GDP, expansion of exports on a much wider spectrum of industries and faster manufacturing growth, but did not constitute a sufficiently strong instrument to induce innovation and catch up in more sophisticated areas of manufacturing. Nor a floating exchange regime neither an administrated exchange policy has been successful in inducing entrepreneurs in Argentina, Brazil and Chile into innovation, more R&D expenditure, and the erection of green field production facilities catching up with the international technological frontier. In the first case the appreciation of the local currency has been shown to discourage investment and innovative efforts. In the second one, although a SCRER has been important revitalizing growth and exports, it was not sufficient to induce firms into expensive and uncertain R&D and innovative efforts. Sector-specific industrial policies seem to be required if firms which are further away from the frontier are to be induced to close the gap [Lee (2011)]. The Korean and Taiwanese experience shows how important sector-specific interventions were in the 1980s for firms like Samsung, LG or Hyundai when they were trying to catch up with world class status [Rasiah (2007)].

On the other hand, inflation targeting policies succeeded in curbing inflation in Brazil and Chile but they could not avoid the economy evolving into non-tradable activities and into further “commoditization.” The macro policy regime ended up affecting the long term competitiveness of more knowledge intensive manufacturing activities [Nassif, Feijó and Araújo (2011, p. 9)].

If the objective of closing up the technological lag and inducing innovation and more R&D efforts in the economy is to be given priority, we conclude that the debate as to whether to opt for an inflation targeting regime, floating the local currency, or to use a SCRER seems somewhat simplistic. Received theory in this field is based on general equilibrium principles and leaves out of consideration the fact that large productivity differentials prevail across industries vis-à-vis the international frontier. Neutral market signals can not capture said differentials and can not therefore act as an adequate incentive in the case of firms placed further away from the frontier inducing them into risky and uncertain long term investment and innovative efforts. Our friend Fabio understood that all along and it is fair this to be explicitly recognized. A SCRER might bring more exports, but catching up with the frontier probably involves a pro-active industrial policy and the appropriate set of institutions that comes with it.

We then move into micro aspects related to the governance of “commons,” the creation of “collective action” and of government regulatory capacity to supplement for the role of markets acquire paramount importance. We have seen that a complex interaction obtains between ecological, economic and institutional forces that develop independently and do not combine easily. How to design and enforce long term National Strategies aiming at the sustainable use of natural resources is an urgent need in most Latin American countries. R&D and knowledge generation efforts looking at location-specific issues of optimal loading capacity and environmental sustainability should be made a central part of said National Strategy. What the regulatory role of the Public Sector should be and how to secure adequate enforceable and fiscalization capacity in circumstances in which Public Sector agencies have a long tradition of weakness, also appears as a major policy question for urgent consideration. Building up collective action, trust and public/private cooperation in relation to the long term sustainability of commons, developing institutional fairness with the original people which have been living in many of the commons since pre-colonial times also appear as areas in which Latin American development policies will have to improve in the years ahead. The above are not social capabilities a country can bring from abroad. They need patiently to be developed locally through an unavoidable process of trial and error.

Referências Bibliográficas

ALBRIEU, R. (2011) La enfermedad brasileña y sus causas. Observatorio Económico de la Red Mercosur, 14 jul. 2011. Available in:

BISANG, R.; CAMPI, M. (2007) Biotechnologia y desarrollo. , Buenos Aires: Cepal, Oficina, Nov.

CASTINEIRA, R. (2012) 2013 es una oportunidad para no chocar en 2014. , Econometrica SA., Informe semanal. Buenos Aires, 17th Oct.

OUAI, A.; MEARMAN, A.; NEGRU, I. (2012) . Prospects for a heterodox economics of the environment and sustainability. , Cambridge Journal of Economics, p. 1019-1032

ERBER F. (2011) As convenções de desenvolvimento no governo Lula: um ensaio de economia política. , Revista de Economia Política, Jan.

ERBER, F.; CASSIOLATO, E. (1997) Política industrial: teoria e prática no Brasil e na OCDE. , Revista de Economia Política, Vol.17, N. 2. Apr.-Jun.,

FANELLI, J. M.; FRENKEL, R. (1996) Estabilidad y estructura. Interacciones en el crecimiento economico. , En: KATZ, J. (ed.). Estabilización macroeconómica, reforma structural y comportamiento industrial. Buenos Aires: Cepal/IDRC/ Alianza Editorial,

FRENKEL R.; RAPETTI, M. (2010) A concise history of exchange rate regimes in Latin America. , Buenos Aires: CEDES, (Mimeo)

HARDIN, G. (1968) The tragedy of the commons. , Science, N. 3.859, V. 162, Dec.

JENKINS, R. (2011) The “China effect” on commodity prices and Latin American export earnings. , CEPAL Review, 103, Apr.

KATZ J.; BERNAT, G. (2011) Macroeconomic adjustment and structural change – The experience of Argentina, Brazil and Chile in 2000-2010. , Innovation and Development. Oxford: Taylor and Francis,

KATZ J.; IIZUKA M. (2011) Natural resource industries, tragedy of the commons and the case of Chilean salmon farming., International Journal of Institutions and Economy, 3, 259-286,

KIM, L. (1997) Imitation to innovation. The dynamics of Korea’s technological learning., Harvard Business School Press,

LEE, K. (2011) Economics of catch up and the East Asian economies., Seoul: Seoul National University, Jul.

LUNDVALL, B. A. (2004) Innovation, growth and social cohesion: the Danish model. , Amazon,

NASSIF, A.; FEIJÓ, C.; ARAÚJO, E. (2011) The trend of the real exchange rate overvaluation in open emerging economies – The case of Brazil., May. (Mimeo)

NELSON, R. (1998) The agenda for growth theory – a different point of view. , Cambridge Journal of Economics, 22, p. 497-500,

OCAMPO, J.A. (2007) The macroeconomics of Latin American economic boom. , CEPAL Review, p. 7-28, Dec.

OSTROM E. (1990) Governing the commons.The evolution of institutions for collective action. , Cambridge University Press,

OSTROM E. (2009) A general framework for analysing sustainability of socio-ecological systems. , Science 24, V. 325419-422, N. 5.939, Jul.

PANGUE, W. (2005) Transgenic crops in Argentina: The ecological and social debt., Bulletin of Science, Technology and Society. V. 25. N. 4, Aug.

PEREIRA, C. L. B. (2010) Globalization and competition. Why some emerging countries succeeded while others fall behind. , Cambridge University Press,

POTEETE, A. R. & OSTROM, E (2004) . In pursuit of comparable concepts and data about collective action. , Agricultural Systems, vol. 82(3), p. 215-232, Dec.

RASIAH, R. (2007) Learning and immitation in the semiconductor industry in EastAsia, (Mimeo)

TRIGO, E.; CAP, E. J. (2003) The impact of the introduction of transgenic crops in Argentinean agriculture. , AgBioForum, vol. 6, n. 3. Buenos Aires: Grupo CEO S.A., INTA,

Artigos relacionados

In: Encontro Nacional da Indústria, 1984

A Política Tecnológica da Segunda Metade dos Anos Oitenta

Estratégias de desenvolvimento, política industrial e inovação: ensaios em memória de Fabio Erber, 2014

Um economista do desenvolvimento

Estratégias de desenvolvimento, política industrial e inovação: ensaios em memória de Fabio Erber, 2014