Development Projects and Growth under Finance Domination: The case of Brazil during the Lula Years (2003-2007)

Fabio S. Erber, Armand Colin | « Revue Tiers Monde » 2008/3 n° 195 / pages 597 à 629

Le gouvernement de LULA est arrivé au pouvoir à un moment de crise du modèle de développement libéral au Brésil. Il comprit tout de suite qu’il fallait trouver un autre projet de développement et fit plusieurs propositions destinées à retrouver une croissance forte et durable. Le succès de ces «conventions de développement» fut limité et la croissance resta faible et irrégulière. Le concept de «convention de développement» qui s’inscrit dans la tradition de l’économie politique est brièvement exposé au début de l’article. L’article démontre que les deux phénomènes – croissance molle et irrégulière, et absence de projet de développement – ont une origine commune: la domination de la politique économique par une coalition d’intérêts structurés par des taux d’intérêt élevés. Cette domination financière s’exprime dans les politiques monétaires, fiscales et de taux de change menées par la Banque centrale et le ministère des Finances, politiques qui sont justifiées du point de vue de la stabilité des prix, laquelle figure comme une condition préalable à tout projet de développement. Comme les phénomènes de path-dependence (dépendance de sentier institutionnel) jouent un rôle important dans notre démonstration, nous commençons l’étude par une description rapide des conditions politiques et économiques dans lesquelles se sont déroulées les élections de 2002, et des incertitudes qui en ont découlé aux premiers temps de l’administration LULA en 2003. Nous examinons ensuite les diverses stratégies de développement proposées par le gou- vernement, les politiques macroéconomiques effectivement mises en œuvre, les chiffres de la croissance pour la période et les contraintes que les politiques macroéconomiques faisaient peser sur la croissance. Nous concluons en interprétant le cas brésilien à la lumière de la récente théorie du développement et de l’expérience d’autres pays, en montrant que la présente convention hégémonique est une «convention de stabilité» et non une «convention de développement».

The growth of the Brazilian economy during President LULA’s tenure (2003- 2007) was limited and uneven, far below the Latin American average and further below the average of other “emergent” countries such as China, India and Russia. Such a performance cannot be ascribed to international conditions – quite the contrary, these were exceptionally favorable. Its causes have to be sought internally.

Given the uncertainty inherent to any development process, growth is facilitated if there is a “development convention”1 – a cognitive device, shared by the hegemonic decision-makers, which is used to establish a positive and a negative agenda: which problems come first and which solutions to such problems are legitimate. Such conventions are made up by codified and tacit knowledge – theories about economics, politics, and sociology belong to the first group and myths to the second one2. In other words, uncertainty is reduced and coordina- tion of the strategies of the social actors is induced when there is a “development project”3. If institutions are “the rules of the game”, a development convention is an institution. The role it plays in defining the positive and negative agendas of social actors, places it high in the hierarchical order – a “constitutional institution”.

A “development project” is always presented as “national”, leading to the “common good”. In fact, it reflects the distribution of power, both economic and political, prevailing in that society. Nonetheless, since development is a dynamic process of structural change, an efficient project must offer scope to emerging groups others than those present in the power block ruling that society, especially when the regime is democratic.

Although there are always several conventions competing for hegemony, one tends to be dominant, except during periods of crisis, such as the decade of the eighties in Brazil, when the developmental convention had lost its power, but the competing liberal convention had not become dominant yet.

Development conventions evolve and adapt to both national and international changing conditions. They are akin to Lakatos’research programs, in the sense of being made up of a “hard core” of an axiomatic nature, and of a “protective belt” used to accommodate changes. Such an evolution process is path-dependent – it shows incremental growth and presents ruptures at points of crises, and it is heavily influenced by the history of the society holding the convention4.

The LULA administration came to power at a moment of crisis of liberal development in Brazil. From its very beginning, it recognized the need for an alternative development project and, in fact, put forward several proposals to resume high and sustained growth. Such proposals met limited success and growth has been slow and irregular.

This paper, nested in the tradition of political economy, argues that both phenomena – slow and uneven growth and lack of a development project – have a common root: economic policies dominated by a coalition of interests structured by high interest rates. Such financial dominance is expressed in monetary, foreign exchange and fiscal policies carried out by the Central Bank and the Finance Ministry, which are justified in terms of price stability, the latter being laid down as a precondition to any development project.

Since “history matters” and path-dependence plays a major role in our argument, the next section sets the stage at the beginning of the LULA administration, outlining the political and economic factors surrounding his election in 2002, and the ensuing uncertainty at the beginning of the administration in 2003.

Section 3 examines the different development strategies proposed by the Government at the beginning of the two mandates, in 2003 and 2007, finding its complement in section 4, which presents the Central Bank’s views and the macroeconomic policies actually put into practice.

Section 5 presents the growth record of the period and the constraints macroeconomic policies put on growth.

The last section suggests some interpretations of the Brazilian case in the light of recent development theory, and of the experience of other countries.

1. Setting the Stage: Uncertainty and Change in 2003

In every culture, the first day of the year is heavily laden with symbolism of renewal but, in Brazil, the first of January of 2003 was truly exceptional: it was Inauguration Day for President LULA, elected by a coalition of parties led by the Workers Party (PT).

By 2002 it had been the fourth time LULA ran as candidate for the Presidential seat. His previous defeats could be ascribed to fear that he and his party would not be competent to deal with the hyper-inflation and foreign exchange crises (1989 and 1998, respectively) and the fear he would undo the successful Real stabilization plan carried out by his opponent (Fernando Henrique CARDOSO) (1994 and 1998). Fear also of the rhetorical allegiance of both LULA and the PT, to socialism, however ill-defined the latter was. Fear and social prejudice against a politician and a party of working class origin and which held strong links with the organized social movements (trade unions, landless peasant, etc). Such fears seemed to resist the obvious fact that the man and his party had become much more “pragmatic” over time. As LULA stated in a 1997 interview, his success was due to not being bound by “ideological schemes”5 (COUTO, 1999). By 2002 the PT had become a bureaucratic institution, where militants and social movements had lost influence (BETTO, 2006).

In 2002 the candidate from CARDOSO’s party tried to play, once again, the fear card. External conditions were in his favor: the world economy was still reeling from September 11 and the end of the “new technologies” bubble, Argentina was deep into its debt crisis and war was imminent in the Gulf. In institutions where LULA electors were few, the fear game became operational: foreign investment dried up, the Real devalued, and current and estimated inflation shot up6. A clear signal was given to the candidate and his team. The response was prompt, if ambiguous: in mid 2002, in a widely publicized statement (Letter to the Brazilians) LULA, while reiterating the need to “change the model”, committed his future government to “honour the contracts”. This was amplified by a commitment to keep the agreement established by the CARDOSO Government with the IMF. Albeit with less publicity he also put out bridges to the “market” institutions, such as the powerful Banks Federation (FEBRABAN). The Government Program of the coalition of parties supporting his candidacy, also issued in mid 2002, dropped the slogan of “rupture of the model” in favor of a “lucid transition”.

All cards worked only partially. On the one hand, market indicators continued to deteriorate sharply during the second semester of 2002. On the other the population, besieged by low growth, high unemployment and, to cap it, by an energy crisis7, elected LULA. As he put it: “hope won over fear”.

Therefore, on the first of January 2003, in Brazil, the hopes for renewal were tinged with considerable uncertainty about the future. Among economists some points were consensual: the need to resume growth and employment and to go back to price stability, and the constraints on both objectives born out of foreign exchange scarcity and infrastructure (especially energy and transports) availability. Consensus stopped there: there was a wide array of dissent, from whether the focus should lie on the productive structure (as in developmental times) or on market-friendly institutions (as argued by neo-liberals), to the relative roles State and market should play. Some specific solutions to the problems of stability and growth, such as reforming the Social Security System, formal independence of the Central Bank, control of financial foreign capital, and the need for industrial policy, were especially divisive. A clear indication of the course the new adminis- tration intended to take was urgently needed.

2. Development Projects Galore

On January first 2003 President LULA made two Inauguration speeches: one to the festive huge crowd assembled in front the Planalto Palace and another, longer and more formal, at the Congress8.

Addressing the Congress, LULA reiterated that “change was the key-word”, that the previous model was defunct. Nonetheless, change had to be gradual, pursued with patience and perseverance. To do so, he stressed, a national development project was necessary, and so was a strategic planning.

Such project should be directed primarily towards the needs of the underprivileged – it should focus on providing education and health and, above, all, on eradicating hunger.

As means to such objectives he stated the need for macroeconomic stability and, specifically, a responsible management of public finances. Growth would be a result of an increase in savings and investments, including human capital. The focus would be on the domestic market, especially on small and medium-size enterprises, on infrastructure and on technological capability. A wide range of institutional reforms were mentioned concerning social security and, labor legislation, as well as fiscal, agrarian, and political reforms. To carry out such an ambitious program, he pleaded for a “social pact” uniting labor and capital, in order to generate a “solidarity energy”.

On the international front he intended to introduce changes too. Regionally, top priority should go to South America. Tradewise, he wished to reduce protectionism in the more industrialized countries and to increase the technological content of Brazilian exports. Foreign direct investment was welcome but its role was not emphasized – a substantial change as regards the CARDOSO government, when foreign investment was seen as the demiurge of development.

Silence is as eloquent as speech. Financial capital, be it foreign or local, is not even mentioned. Political parties are given short shrift too. What is stressed is a direct family-type relationship between LULA and the “people”, in which he sees himself as embodying the “dreams of generations”.

Designed to build consensus, the Inauguration speeches left plenty of scope for different interpretations, as shown by two important ensuing documents, published in early 2003.

The Finance Ministry (Ministério da Fazenda, 2003) toed the line by stating that the “social inclusion” was the central axis of a “new development cycle” but made the point that the level of social expenditures by the Brazilian State was already high – the problem was that such expenditures (notably transfers associated with social security) had “non-poor” as beneficiaries. In other words, social policy in Brazil was inefficient. To remedy that, policies directed towards social inclusion should focus on the “poor” only, as opposed to the traditional PT view that social policies should be “republican and universal”.

As expected, the Finance Ministry reiterated that inflation control was essential and put emphasis on fiscal policy in order to stabilize prices. Moreover, priority should be given to institutional reforms with the “importance of institutional and legal development for the appropriate working of markets and public policies” as their “unifying theme”. The neo-classical variety of New Institutional Economics, in which institutions which guarantee property rights, reduce transaction costs and enhance technical progress are the key to development (NORTH, 1992) was a clear inspiration to the Finance Ministry team. The Ministry had four priority reforms: two were directly geared to fiscal problems: social security and fiscal reform itself ; the other two to the financial system: the legal autonomy of the Central Bank and the reinforcement of creditors’rights, assuming that the latter would then reduce interest rates.

Almost simultaneously, the Planning Ministry published the “Directives” for the new 2003-2007 Investment Plan of the Federal Government (Ministério do Planejamento, 2003), which closely reflects the proposals of the coalition of parties who had backed up LULA’s candidacy. The social objectives of the Government would be achieved by a virtuous circle between the demand of workers’households for consumer goods, and investment, leading to productivity increase, lower prices and more exports. The virtuous circle required increasing the real wage of workers’families. However, given the scarcity of jobs and market failures which reduced the transfer of productivity growth to wages, policies were required to compensate for such failures. As a consequence, the “social” objectives of inclusion and reduction of inequality would converge with the “economic” operation of the virtuous circle.

The reading of KEYNES by FURTADO, who strenuously and repeatedly9 warned that the Keynesian virtuous circle between consumption and investment would not arise spontaneously under the conditions of underdevelopment, lies behind the Plan.

Differences with the Finance Ministry document go further. The State, here, is given a stronger role as “leader of social and regional development and inducer of economic development”. As regards institutional reform, while sharing the consensus on the need for reforms of the fiscal and social security systems, the Plan ascribes little importance to the improvement of creditors’rights and does not even mention autonomy of the Central Bank.

Later on, the two Ministries would agree on the institutional solution for the problem of investment in infrastructure through public/private partnerships (PPP), whereby the state would guarantee a minimum rate of return to private investors. Widely touted by a consulting firm, such institutional device elicited little enthusiasm among private investors10.

Once again, silence is eloquent. The concern with efficiency (Finance Ministry) and with the role of the State (Planning Ministry) did not lead to a proposal of State reform, to deal with the thorny problems of policy coordination, monitoring and evaluation. The Government implemented the “social pact” idea in the most traditional way: multiplying the number of councils and fora, bringing entrepreneurs, workers and State officials together. The latter are usually de officio members but the former two are normally co-opted on the basis of their personal prestige or are indicated by institutions. Notwithstanding their rhetorical role, such councils have little efficiency value.

Finally, still in 2003, the Government announced its Directives for a policy which embraced industrial and technological development and foreign trade – a novelty in itself (Ministério da Indústria e Comércio, 2003). The policy (PITCE11), predicated on innovation and the reduction of trade deficits. The two were linked by the difference in technology intensiveness of Brazilian foreign trade and by the related income elasticity. Since Brazilian exports have a lower technology intensiveness than imports and because it was assumed that income elasticity is correlated with technology intensiveness, the conclusion was that the foreign trade structure had a built-in deficit, since the growth rate of imports would tend to be higher than the growth rate of exports – a view which harks back to the famous PREBISCH-SINGER thesis, updated by a neo-Schumpeterian approach.

This diagnosis of a foreign trade constraint was not highly contentious. Even less contentious was the emphasis on innovation – a meeting ground for economists of all persuasions. In fact, increasing the GNP share of national expenditures for science and technology has been a stated objective of all Brazilian governments since the eighties.

Where PITCE caused a stir, was in its sector selectiveness – by choosing four sectors as priorities it harked back to the Developmental State, where sector policies were paramount12. The selected sectors were technology intensive and carried large trade deficits: software, electronic components, capital goods and pharmaceuticals, to which were added two pervasive technologies, dubbed “future carriers”: nanotechnologies and biotechnologies. Later on, biomass was added to the list. Although pharmaceuticals could be justified in terms of their social importance, the rationale of PITCE was not dependent on its direct impact on “social inclusion”.

Therefore, during the first year of the LULA administration we had at least three different interpretations of his call for a “development project”. Such abundance of proposals is self-defeating for the purposes of uncertainty reduction and agent coordination, and precluded the “strategic planning” he argued for. The macroeconomic policies later described compounded the difficulties.

Four years later, reelected but with no festive crowd in front of the Palace, he made a new Inauguration speech at the Congress. The underprivileged continued to be the priority, but “change”, now, should be “fast”. The “strategic vision of development” and the “social pact” were to be based on the twin pillars of public and private investment, directed mainly towards a Program to Accelerate Growth (PAC – Programa de Aceleração do Crescimento). The latter is essentially a large program (more than R$ 500 billion, i.e. US$ 290 billion) of investments in infrastructure, of which about 55% would go to energy projects, a third to urban infrastructure and the rest to logistics.

If successful, such a Program would reestablish the old developmental pact, in which coalesced the whole chain of supply of construction goods and services, suppliers of capital goods and workers (mostly with low educational requirements).

The Plan assumed that macroeconomic conditions would be stable over the next mandate (2007-2010): GNP would grow steadily, at 4.5% in 2007 and at 5% p.a. the next years. Inflation would be 4.1% in the first year and then stabilize at 4.5% for the rest of the period. The nominal basic interest rate would slowly decline, from 12.2% in 2007 to 10.1% in 2010 and the primary fiscal surplus would remain stable at 4.25% of GNP throughout the period.

3. The Compromise: Macroeconomic and Social Policies

In practice, the LULA administration implemented bits and pieces of all the projects outlined above. We shall first comment on the 2003 projects, leaving the comments on the 2007 project until after a description of the macroeconomic policy.

Given the role played by the foreign exchange constraint on Brazilian growth and on the initial development projects, it is convenient to begin with the evolution of external conditions.

LULA’s external policy was partially consistent with the outlines presented in his Inauguration speech. The Brazilian Government has kept a high profile on issues such as world hunger reduction and peace-keeping (e.g. in Haiti) and strenuously fought for a seat in the U.N. Security Council. South American integration was sought by political, trade and investment cooperation13, while negotiations with the USA over the continental free trade zone and the UE-Mercosul talks stalled. As regards trade, it has fought for a reduction in protectionism from the more developed countries, especially as regards primary products, and actively strengthened trade with other developing countries. Much less emphasis was put on increasing the technology content of exports. In fact, Brazilian trade policy has been directed more to expanding markets for products already exported rather than to diversifying the range of exports (PINHEIRO and BONELLI, 2007).

Although it amounts to a change as regards the CARDOSO governments (VIGEVANI and CEPALUNI, 2007), the policy renews, under different global conditions, the striving for greater national autonomy, one of the traditional stands of Brazilian foreign policy.

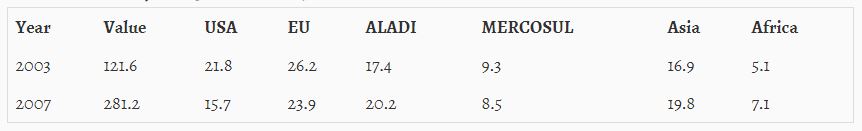

Table 1 – Brazilian Trade Flow by Region, total value (US$ billion) and percentage, 2003 and 2007

Table 1 shows that the total Brazilian trade flow (exports + imports) not only more than doubled between 2003 and 2007, but also that it shifted towards the South: especially to Latin America, and diversified beyond Mercosul, and Asia.

However, since the share of developing countries in world trade has increased too14, the efficacy of the new external policy is not clear.

Disaggregating the trade flows we find that the value of Brazilian exports more than doubled (220%) between 2003 and 2007, increasing their share in the world total from 0.96% in 2003 to 1,15% in 200615. However, imports rose faster (250%), so that in 2007 the trade surplus was 10% lower than two years earlier. Given such trend, it is estimated that the trade surplus may disappear by the end of 2009, if not sooner.

By 2007 manufactured products still accounted for more than half (52.2%) of Brazilian exports, but this share has declined since 2003, when it was 54.4% (FUNCEX data). As shown by FILGUEIRAS and GONÇALVES (2007), products of low technology intensiveness accounted for 47.4% of manufactured exports over the period 2003-2006, while highly technology-intensive products (mainly airplanes and cell phones) accounted for 8.5% of such exports. Semi-manufactured products lost ground too – from 14.8% of exports in 2003 to 13.6% in 2007. The winners were primary products, which increased their share of exports from 28.9% to 32.4% (FUNCEX). Natural resources-intensive products make up the bulk of semi-manufactured exports, as well as a substantial share of the scale intensive manufactured exports16. Revenues from primary exports are highly dependent on the price increase of such products: between 2003 and 2007 the FUNCEX quantum index of such exports increased by 144%, while the price index grew by 170%.

The rise in price of commodities has also taken a toll on the import side: despite the growth of Brazilian oil production, fuels have increased their share of imports between 2003 and 2007, from 13.4% to 17%. Production goods (capital goods and intermediate products which enter the production process) have lost ground, from 77% to 72% of imports, while consumer goods have gained in import share, from 9.3% to 10.7% (FUNCEX).

Exports have played a major role in the growth of the Brazilian economy and imports of production goods have been hailed as an important tool in order to increase productive capacity and, hence, prevent demand inflationary pressures. Nonetheless, the evolution of the structure of exports makes it very sensitive to the commodity cycle. Moreover, given the divergent rates of growth of imports and exports, the lifting of the foreign exchange constraint by means of trade seems to be bound to end quite soon.

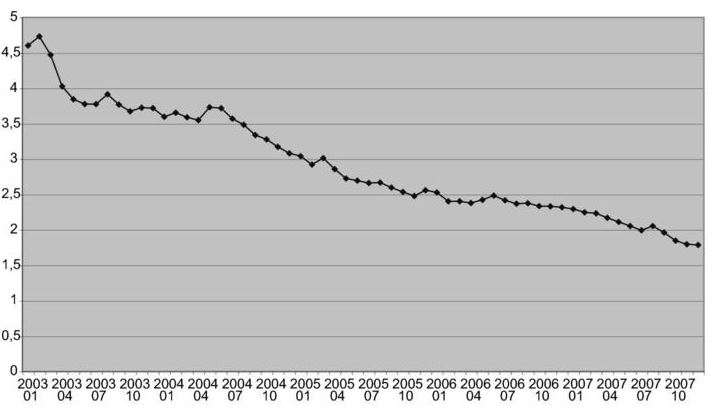

Given the policy of maintaining the foreign exchange free to fluctuate, the trade surplus coalesced with the huge inflows of capital attracted by the very high interest rates (see below) and led to substantial appreciation of the Brazilian currency, as shown in Graph 1.

Graph 1 – Real exchange rate: R$/US$, 2003-2007

Such appreciation leads to a decline in the profitability of exports17, providing negative incentives to such activities, but primary producers are less affected than manufacturers. Moreover, exporters of primary products are not threatened in the domestic market by a foreign competition enhanced by an over-valued exchange rate, as are most manufacture exporters, as well as the other non – exporting industrial enterprises18. Hence the imbalance between primary and industrial production incentives. In other words, Brazil may have been prey to the Dutch disease, which BRESSER-PEREIRA (2008) has cogently pointed as a major threat to development.

Importers and debtors of foreign credits are the most obvious beneficiaries of the exchange rate appreciation, but enterprises (and individuals) which have to send money abroad also benefit from it – to pay for profits, dividends, and interests, and for foreign investments (which averaged US$ 9.6 billion per year over the 2003-2007 period, performed by large enterprises producing primary goods, such as minerals or semi-manufactured products such as steel slabs). As a consequence, the overvalued exchange rate weds powerful economic interests.

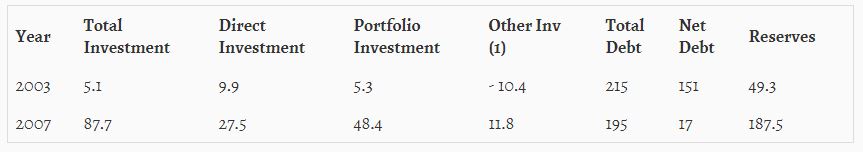

Dutch disease analyses tend to focus on the trade balance, but in the Brazilian case the main source of foreign exchange rate appreciation seems to lay on the capital account. Table 2 presents the basic data for this account for the years 2003 and 2007.

Table 2 – The capital account of the Brazilian Balance of Payments by type of capital, foreign debt (total and net) and foreign exchange reserves in US$ billion, 2003 and 2007

The changes reported in Table 2 are the result of three convergent phenomena: the liquidity of the international market, low prime rates prevailing in developed countries and, as a consequence of the monetary policy described below, very high interest rates earned in Brazil and the related expansion of the securities and equity markets19 – notice the weight of portfolio investment. Such inflows of capital have as a counterpart the remittances of interests, profits and dividends, which increased from US$ 18.6 billion in 2003 to US$ 28.6 billion in 2007. In 2003 the total current account (trade balance and factor and non-factor services) was in a surplus position for the first time since the Real stabilization plan – US$ 4.2 billion, equivalent to 0.75% of the GNP. Fuelled by the trade balance, this surplus peaked at US$ 14 billion (1.58% of GNP) in 2005 but has since declined – to US$ 3.3 billion (0.26% of GNP) in 2007 (Banco Central). Should the trade balance soon become negative, the role of the capital account in maintaining the foreign balance of payments in order will increase. This, in turn, locks in the monetary policy in its high interest stance, which, if successful, in turn locks in the foreign exchange rate evolution, with perverse effects upon productive investment, more fully discussed below.

Analysts of the Dutch disease tend to focus on its effects upon the productive sector, but it may have institutional consequences too. PITCE is a good example. Budget allocations, fiscal and credit incentives for innovation and aimed at strengthening the relationship between enterprises, universities, and research centers increased20. However, the priority attached to the technology-intensive sectors was substantially dampened. This may be attributed to the temporary lifting of the foreign exchange constraint and to the positive evaluation of the upsurge in technology-intensive imports.

In other words, the role of PITCE as a vector of change in the productive structure has been reduced and its instrumentality turned to a more canonical “horizontal” lineage. In development theory terms, the emphasis shifted from a developmental neo-Schumpeterian approach to an endogenous-cum-natural- comparative-advantage growth. However, the declining trade surplus revived the interest in industrial policy and, by the end of 2007, a new policy was in the making at BNDES, directed towards manufacture exports and innovation.

As regards the institutional reforms put forward by the Finance Ministry, fiscal and social security regulations were changed in order to provide incentives to private investment and to reduce retirement and pension expenditures. Foreign investment in public debt securities also got fiscal incentives.

The financial system got the increased protection of creditor’s rights and, at least as important, the right to lend money to private individuals with the payment of the debt being deducted from their monthly wages (i.e. a payroll-backed low-risk credit). Although the Central Bank did not get its legal independence as ambitioned, its President was awarded Ministerial status and the Bank retained full operational independence.

However, the way I read it, the main thrust of the LULA administration is to be found in the compromise between social policies, designed to achieve its economic and political objectives of improving the lot of the underprivileged, and orthodox macro-economic policies which benefit the financial coalition. In the Government view, the connection between the two is established by the fact that high inflation hits harder the poorest segments of society.

Social policies had two main strands. The first is providing basic services, such as electric power (Programa Luz para Todos) and primary education (FUNDEB – Fundo de Desenvolvimento da Educação Básica). Nonetheless, the quality of health and education services remains very low.

The second, and more relevant, is the transfer of income to economically destitute households (Bolsa Família), and the increase of the minimum wage.

Bolsa Família (Family Grant) brought together several programs devised under the previous administration for distinct purposes (allowances for schooling, food and gas) and greatly expanded their scope, coverage and visibility. It is targeted at families with a monthly per capita income below R$ 120 (US$ 66.6), and provides between R$ 18 and R$ 112 (US$ 10 and US$ 64) per month, depending on family conditions. In return children must attend school and get vaccinated, while pregnant women must undergo pre-natal care.

Bolsa Família is conceived according to the “targeted universe” canon of international agencies such as the World Bank, endorsed by the Finance Ministry in its 2003 document. But, given the unequal income distribution and the size of the population, its universe is huge: in 2007 it benefited around 11 million families (about 46 million people). About half of the beneficiaries are located in the Northeastern region and it is estimated that Bolsa Família increases their revenue by close to 60% (Globo OnLine, 26/12/2007) – a testimony to the poverty of that population.

The program is often criticized for not addressing the structural causes of poverty such as assets distribution, and for not offering an “exit door” to those benefiting from it, i.e. for being merely palliative and perpetuating poverty conditions. Nonetheless it is certainly a step towards relieving the extreme poverty prevailing in Brazil and has the undoubted merit of bringing such poverty to the fore, an important change in the political agenda of the Nation.

Minimum wage, defined yearly, was raised by the Government by an average of 8,1% in real terms over the period 2003-2006 and by 4,4% in 2007. Its impact goes way beyond employees, since most social security benefits are indexed to the minimum wage (GIAMBIAGI, 2007).

The populations benefiting from Bolsa Família and the rise of minimum wage are not the same. Looking at the country’s income distribution deciles, the beneficiaries are concentrated in the first (poorest) tenth while minimum wage earners are concentrated on the second and, especially, third tenths (SABÓIA, 2007).

As a consequence, the macroeconomic impact of the two policies are distinct. As regards consumption, Bolsa Família increases mainly the sales of wage goods – it is no accident that supermarket sales have increased most in the Northeast. The increase in the minimum wage, coupled to an increase in employment and to credit expansion (see below) has fuelled a boom in sales of durable goods.

Their fiscal impact is also very distinct. Together with older transfer programs, Bolsa Familia accounted for less than 1% of GNP in 200621 while the increase in the minimum wage affects the social security bill and wages paid by the public sector (GIAMBIAGI, 2007).

Finally, the two policies have complementary political effects – it is not surprising that in the 2006 election the regions which benefited most from the social policies provided the bulk of the votes which led to LULA’s victory.

Let us now look at macro-economic policies. At the beginning of LULA’s first mandate, there was no doubt that a firm stance on macroeconomic policies was required in order to bring financial and foreign exchange markets back to normality, after they had erupted in the second half of 2002. The government complied with such expectations with textbook orthodoxy: the National Monetary Council set severe fiscal and inflation targets and let the foreign exchange fluctuate, with no capital or import controls.

The rationale of this policy is well-known: price stability is a condition for sustainable growth. Stability creates an environment in which relative prices play their allocation role efficiently, fiscal and private accounting systems are trustworthy and long term contracts and funding can be signed in confidence. In other words, the objectives of stability and growth are complementary. No questions are asked about the distributive consequences of relative prices or about the distribution of assets. It is a view shared by the Brazilian Central Bank together with its counterparts all over the world22.

Uncertainty remained: would this tough and orthodox policy simply be a transition to more heterodox policies, such as those advocated in LULA’s election program, or would it be permanent? Those who bet on the second alternative won.

An explanation of some of its institutional traits might be useful if one is to understand Brazilian macro-policy. Policy is discussed in many various councils, but decisions are made by the National Monetary Council. The latter is made up of the Ministers of Finance and Planning and the President of the Central Bank. Of the two Ministers, the former is incomparably the most powerful23.

In mid-year, the Monetary Council sets fiscal and monetary targets24 for the calendar year two years ahead. Nonetheless, under special circumstances the Central Bank may modify the inflation target25. Fiscal objectives are set in terms of primary surplus. This target limits public investment but leaves a wide space for monetary policies since it does not include interest payments. Monetary targets are expressed by a wide consumer-price index26. The full index is used, in spite of the weight (about 30% of the index) of prices which are pegged to other indexes, such as the price of utilities27. The exchange rate fluctuates, but the Central Bank may intervene.

The Central Bank has a considerable say in the setting of the inflation target, and enjoys full autonomy to set interest rates at a level it deems necessary in order to achieve the target – the decision is taken by a Committee (COPOM) made up of Central Bank executives.

As explained by three of its members: “COPOM guides its policy decisions by its own forecasts for inflation in the relevant time horizon and the respective balance of risks. Market expectations of inflation are important inputs in the BCB’s forecasting models… Expectations, in turn, have been influenced by past inflation behavior, the inflation targets, exchange rate and commodity price developments, economic activity and the stance of monetary policy” (BEVILAQUA et al., 2007, p. 5). They believe that the “backward-looking component of market expectations has been ceding ground to the inflation target, evidence that the IT system is gaining credibility”. However “credibility has not been perfect, so oftentimes inflation expectations seem to have over-reacted to current developments, in particular to upward inflation surprises. Thus the BC often had to act so as to prevent negative short-term developments from contaminating the medium-term outlook. In this sense the process of disinflation has been, and still is, a process of taming inflation expectations” (ibid, emphasis added).

The authors stress the importance of inflation expectations held by the financial sector but do not seem to worry about the possibility that the forecasts may be influenced by the higher returns such institutions earn when the Central Bank raises its rates.

If the Central Bank fails to reach the target, its President has to write a public letter to the Finance Minister explaining why. Minutes of COPOM meetings are available at the site of the Central Bank (bancocentral.gov.br) but such transparency does not apply to the Monetary Council.

Let us now take a look at the actual policies. As regards fiscal policy, the primary surplus targets were achieved: over 2003-2007 when primary surplus was, on average, 4.1% of GNP, the highest average for a government since the mid-eighties, albeit at the cost of increasing the tax burden from 32 to 35% of GNP (GIAMBIAGI, 2007). In 2007 the Monetary Council excluded some public investments related to the PAC (amounting to 0.5% of GNP) from the primary surplus target.

As for inflation targets, they were also met, except in 2003. Moreover, in 2006 the rate of inflation was lower than the center target, a result repeated, less brilliantly, in 2007. Table 3 compares the targets with the actual inflation rates over the period 2003-2007 and shows the declining trend of inflation, which testifies to the success of the macro-economic policy (in its own terms).

Table 3 – Inflation targets and inflation rates, 2003-2007

Monetary policy was the main instrument used to control inflation. The real basic interest rate (Selic) was, on average, 11,3% per year over the 2003-2006 period. Even after its decline in 2007, it still averaged 7.6% in real terms (GIAMBIAGI, 2007), one of the highest in the world. Private financial investors get rates similar to Selic from the banks, but the latter charge borrowers a multiple of this rate – according to the Central Bank, at the end of 2007 the average interest rates charged to private enterprises were twice the value of Selic, and about four times higher for private individuals (Banco Central, 2007). Given such spread, it is not surprising that banks are the most profitable business in Brazil. Such high lending rates have, in turn, led many enterprises to look for alternative sources of funding abroad or in Brazil, either issuing bonds or stock, leading to a boom in both markets.

Not all borrowers pay the high interest rates mentioned above. Loans for investments and exports granted by the National Development Bank (BNDES), to rural producers (mainly cooperatives and small farms) and for housing enjoy lower interest rates, set by the Monetary Council. Such earmarked credits amounted to around 10% of GNP in 2007. BNDES accounts for about 60% of this total, agriculture for 23% and housing 16%. “Free” credit (in Central Bank parlance) granted by the private financial sector increased from 18% to 24% of GNP from 2003 to 2007, especially for personal credit (Banco Central, 2007).

BNDES is practically the sole internal source of long-term credit for investment. Its budget of about US$ 33 billion makes it one of the largest development banks in the world. It operates directly and, mostly, via private financial institutions, which earn a del credere in such loans and enjoy the indirect benefits of a banker-client relationship with the borrowers. The Monetary Council set the nominal basic rate for BNDES at 11% per year for 2003, cut it down to 9.75% during the two following years and, from 2006, gradually reduced it to the current 6,25% p. a in order to foster private investment,. Two other public banks play major roles in the earmarked credit for agriculture (Banco do Brasil) and housing (Caixa Econômica Federal).

The Central Bank would like to transfer all earmarked resources to the “free” market, under the rationale of increasing the credit availability and thus, supposedly, lowering interest rates. The financial system, a closely knit and well-oiled oligopoly, would like to get such funds too, but without any obligation to fulfill the roles played by public banks. Since these are irreplaceable, the Government has resisted the pressures from the Central Bank and the financial system.

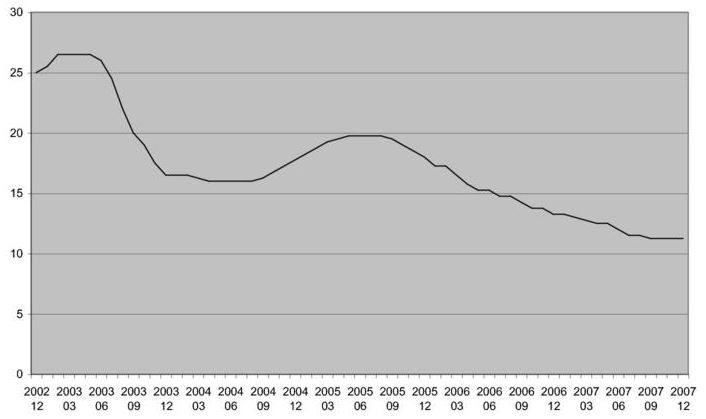

As shown in Graph 2 below, the Central Bank has conducted its monetary policy in a see-saw pattern, raising and cutting down the basic rate. At the beginning of 2003, it increased the rate to offset the inflation upsurge of the second 2002 semester and kept it at high levels until the middle of the year, when lower inflation expectations led to a period of reduction, which lasted until September 2004.

As explained by three COPOM members, in the middle of 2004, there was “heightened uncertainty regarding the external scenario thanks to the looming Fed tightening… and current and expected Real depreciation”28 and “as of mid 2004 the economy was growing by about 5% pa, after two quarters expanding 7% pa, signaling that the output gap was probably closing. Moreover, indices of capacity utilization in manufacturing were above average values, in some sectors actually reaching unprecedented levels. Clearly, these signs suggested… an economy where firms faced favorable conditions to increase their prices” (BEVILAQUA et al., 2007 p.9). A rise in the basic rate was duly implemented which lasted for a year. Accordingly, GNP growth rate fell from 5.7% in 2004 to 3.2% in 2005.

In September 2005 another period of reduction got under way, which lasted until the last quarter of 2007, when the sub-prime crisis led the Bank to halt it, setting the rate at 11.25% per year.

Graph 2 – Nominal Selic Interest Rate (% per year), December 2002-December 2007

Monetary policy found a complement in the foreign exchange rate evolution previously described, which puts a damper on prices of tradable goods.

4. The Doubtful Path of Growth

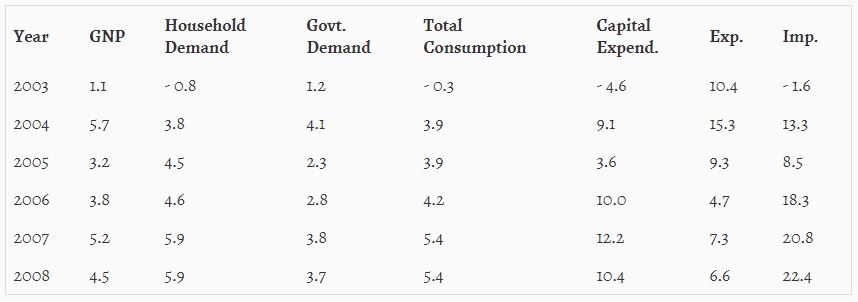

Table 4 shows the rates of growth of Brazilian GDP and of its demand components over the period 2003-2006 and Central Bank’s estimates for 2007 and 200829. Its standard interpretation is that it sums up the two phases of the period as regards growth leaders: from 2003 to 2005 growth was export-led and in the two following years (as well as in the current year) leadership shifted to domestic demand. As argued below, such a view underestimates the role exports continue to play.

Table 4 – Brazilian GDP and its Demand Components, Yearly growth rates 2003-2007 and forecast for 2008 (in%)

4.1. Consumer demand

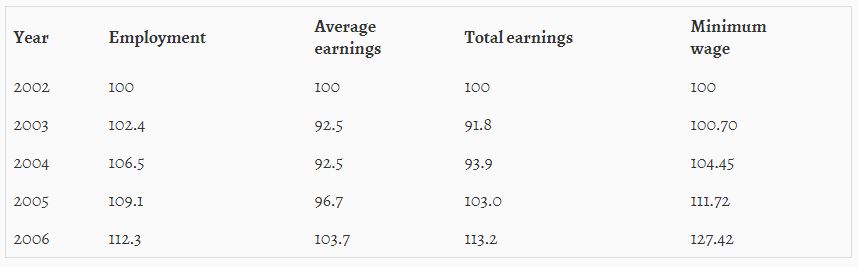

Household demand depends on three factors: employment, earnings and credit. Table 5 shows the evolution of employment, average real earnings of employed persons, total wage earnings and the real minimum wage for the period 2002-2006.

Table 5 – Employment, Real average earning of employed persons, total earning of persons employed, real minimum wage (1), 2002-2006 index numbers

Between 2003 and 2006 the number of persons employed increased by 9.1 million, mostly in the manufacturing industry (1.6 million) and in trade (1.5 million). Moreover, formal employment increased – from 50% to 55% of total. Since about two-thirds of the new jobs created in the period covered by the Table 5 were paid between one and two minimum wages (IEDI, 2008), the expansion of consumer demand in 2005 and 2006 (see Table 4) seems strongly associated with the large increases in the minimum wage paid in these years, especially in 2006. In 2007 the real minimum wage rose by 4.7%, and although the PNAD results are not yet available, the information from the monthly surveys of six metropolitan areas carried out by IBGE indicate that employment kept rising, supporting the growth in consumer demand.

The rise in the minimum wage has been guided mostly by political considerations. Entrepreneurs had long complained that labor legislation multiplies wages, introducing rigidities in the labor market – hence the need for reform, endorsed by the Finance Ministry in its 2003 document. Therefore, it is not surprising that the Central Bank worries about the possible inflationary effects of wage increases. By the end of 2007, it assessed (Banco Central, 2007) that “inflation pressures coming from the (industrial) labor market have not emerged yet” (p. 124) (emphasis added) but also that aggregate costs of labor may be more inflationary, since the industrial market is disciplined by international competition, as opposed to services. From this year onwards, the rise in the minimum wage is pegged to the GNP increase.

It is worthwhile to put such growth of earnings in a longer term perspective. As shown by SABÓIA (2007) the real minimum wage has gone back to its former levels during the “Miracle” period, but it is still a third below its peak at the end of the fifties. As regards personal earnings, there are no such extended time series, but Table 6 shows that the recovery imparted by LULA’s government has but put back such earnings to a more “normal” level – a recovery from the 2003 crisis, but still below the 1996 peak.

Table 6 – Average monthly earnings of employed persons, 1996-2006 index numbers

Expansion of consumer demand has also been fuelled by credit. As shown, the Central Bank reduced its basic rate from September 2005 to the last quarter of 2007. The private financial system reacted by cutting down interest rates for loans to private individuals (“free” credit) but by much less than the Selic reduction30. As a consequence, lending to consumers became relatively more profitable than lending to the Government. At about 45% per year, with inflation a tenth of that value, loans to individuals increased their share of total credit from 31% at the end of 2005 to 34.3% two years later (Banco Central, 2007). To further stimulate borrowing, banks extended the duration of loans31. Moreover, the regulation of payroll-backed loans opened a huge market to the banks, with an increase of 35% in 2007 (Folha On Line, 08/01/2008). Although they are charged lower interest rates (a paltry 29% per year), such loans hold a very small risk to the lenders.

The typical behavior of Brazilian consumers is to check if the monthly installments they have to pay for a loan to buy a durable consumer good “fits” into their monthly disposable income, not bothering with the interest rate they are charged. Consumer debt is higher in the group earning from one to three minimum wages, which has benefited most from the increase in the minimum wage. The level of non-compliance of overall consumer debt increased substantially in 2005 and 2006 but stabilized in 200732. On the other hand, retail chains which sell durable and semi-durable consumer goods, auto dealers and realtors are loath to sell for cash, since they have long-established relationships with the financial system and earn considerable profits from financing.

This debt-driven consumer expansion is not new to Brazil – it fits the observed historical pattern of consumer behavior and it is strongly reminiscent of the “Miracle” years. Given the level of disposable income in most households, it is a rather frail base to support sustained growth.

The policies described above broaden the social basis of support for the Government by including the middle stratum of income which is included neither in the fiscal transfers of the Bolsa Família nor in the rentier group, but it is important to stress the fact that such gains do not derive from the “workers’ struggles” formerly praised by LULA, but are in the nature of a paternalistic “gift” of a good-willing father to the members of his family, the type of relationship stressed in the President’s rhetoric. The weakening of organized social movements, which dates back from the beginning of the liberal period (STEDILE, 2006), has not been reverted during LULA’s mandates – quite the contrary (ibid). In this sense too, it is an essentially conservative strategy.

4.2. Investment

Let us now turn to investment. As shown in Table 4 above, capital expenditures are the fastest growing demand component over the last two years. Once again, it is convenient to put this into perspective. Investment share of GNP in Brazil fell from 20.7% in 1994 to a low 15% by the middle of 2003. Its recent growth puts it back to around 18% of GNP33 – a substantial increase but which still leaves the capital stock growing at merely 2.5% per year34, i. e. not enough to sustain rapid GNP expansion.

The low investment rates observed over the recent past cannot be dissociated from the macro-economic policies of high interest rates which prevailed during its long period of decline. Such policies led private investors to portfolios where the hurdle rate of projects is heightened, since financial investments provide high alternative rates of profit while the financial costs of fixed and working capital increase. Moreover, the short-term horizon and the remarkable fluctuations of the basic interest rate creates a bias in the investment portfolio towards projects with a short pay-off period. The appreciation of the exchange rate, Siamese brother of the monetary policy, reduces the incentive to invest in activities geared to exports or import-substitution. To compensate for such negative incentives, the Government has granted fiscal incentives and reduced the interest rate charged by BNDES for investment.

Squeezed in between interest payments and inflexible current expenditures, and facing a stiff primary surplus target, State investments have languished – over the period 2003-2006 the Federal government invested no more than 0.6% of GNP. The two other public authorities (states and cities) invested another 1.4% of GNP, i. e. less than what was invested during the liberal period (1990-2002). It is estimated that in 2007 there would be a slight increase in those paltry figures – 0.2% of GNP for the federal government and 0.1% for State and city governments (GIAMBIAGI, 2007). Since the tax burden seems to have reached its political limit, the Finance Ministry decided to exclude some investments (0.5% of GNP) from the primary surplus target in order to get the above mentioned infra-structure plan (PAC) under way.

Who invests under such circumstances? Table 7 presents a breakdown of Brazilian capital formation in 2005, by sector.

Table 7 – Gross capital formation in Brazil by sectors, 2005 (in%)

A comparison of investment components in Brazil and OECD countries (PUGA and NASCIMENTO, 2007) shows that the main difference between the two lays in the construction share (housing and non-housing). The housing deficit in Brazil is estimated at 8 million units and it is concentrated on families earning less than three minimum wages. Infrastructure limitations are evident in the appalling conditions of the transport and warehousing systems, in the chaotic conditions of airports and, last but not least, in a possible forthcoming energy shortage.

As regards housing, in 2007 circa 200 thousand units were financed but credit versus income remains a major stumbling block. LULA’s government set new regulations strengthening creditors’rights and increased the budget of the Federal bank in charge of housing. Nevertheless, total credit for housing is still very limited – less than 2% of GNP, much lower than in similar countries, such as Mexico and Chile, and its cost is out of reach for low-income customers (TORRES FILHO and PUGA, 2007).

The Government responded in the beginning of the new mandate with the PAC. The Program estimates that 86.5% of scheduled investments are to be evenly shared between State-owned enterprises (mainly Petrobras and Eletrobras) and private companies, with the balance going to the Federal government. As shown below, Petrobras is pursuing an ambitious energy investment program and Eletrobras has substantial resources of its own, investing about 0.2% of GNP (GIAMBIAGI, 2007). In order to elicit private investments the Government set up a special fund for infra-structure with para-fiscal resources and BNDES reduced the interests charged for such projects.

At the end of 2007 the Government assessed that most projects were running according to schedule, an evaluation strongly denied by the press, which pointed out that many important projects were in fact far behind schedule and that under 30% of expenditures planned by the Federal Government had been actually performed. Such mishap seems to be due mainly to institutional difficulties, such as conflicts over the environmental impact of the projects, and coordination between Government and regulatory agencies.

Underneath such governance difficulties lay deeper and unresolved questions regarding the role of the State in Brazil and the weight to be attached to objectives and timing.

As for the first, the LULA administration inherited an incomplete transition from a State which was principal, and agent to a State which delegated regulation to specialized agencies. During the LULA years, privatization was halted and the relationship between Executive and regulatory agencies has been strained (Central Bank excepted) but political and legal considerations have prevented a reversal of the process. The stalemate continues and its cost is paid in terms of poor governance and slower growth.

As for the second, there are strong conflicts within the Government and within society about the relative priorities to be attached to different objectives, such as rapid capital accumulation and ensuing growth, on the one hand, and protection of the natural environment and international reputation on the other. Again: although the first objective has tended to predominate, this is not followed by the necessary institutional changes, leading to a process in which both objectives get thwarted, leading to slower and lessened growth, and limited environment protection.

In other words, the project of growth through investment in infrastructure is hampered by political and institutional ambiguities, which, in turn, relate to the absence of a development convention. These difficulties coalesce with the constraints imposed by macroeconomic policies.

Investment in agriculture, as indicated by the production of capital goods for this sector35 followed the international market, mediated by the exchange rate – it increased in 2003 and 2004, took a deep dive in 2005 and 2006 with the exchange rate valorization, but came back in 2007, led by favorable crop conditions.

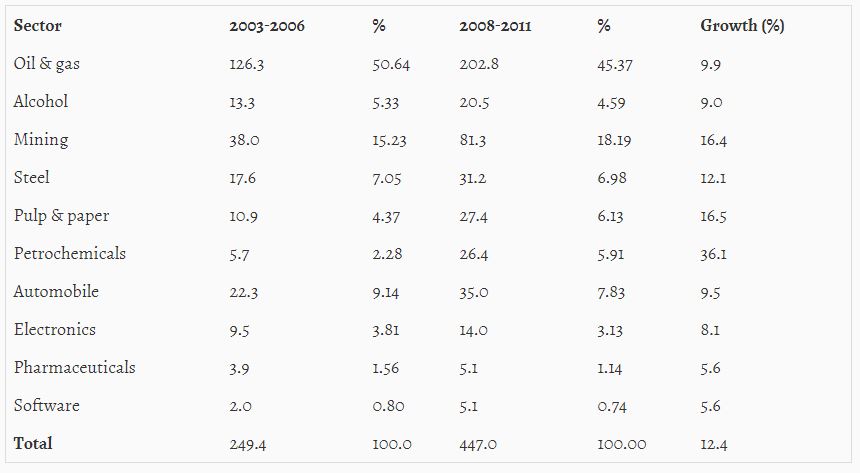

As for industry and mining, Table 8 shows estimates of investments over the 2003-2006 and 2008-2011 periods, covering the sectors accounting for 70% of total industrial investments (PUGA and BORÇA Jr., 2007).

Table 8 – Investments in Brazil by sectors, 2003-2006 and 2008-2011 (in R$ billions)

Investments over 2003-2006 concentrated within five sectors: oil and gas (50.6%)36, mining (15.2%), steel (7%), pulp and paper (4.4%) and petrochemicals (2.2%). The same sectors will increase their share to 83% of the total during 2008-2011 Those are scale and natural resources-intensive sectors, where projects are highly capital-intensive37, performed by large enterprises with access to foreign supplier credits, which tend to import a substantial part of their equipment, thus reducing their links to locally established machinery suppliers. Such investments are geared to import-substitution-cum-exports (oil and gas and petrochemicals) and to building scale-competitive plants in order to maintain market share in a growing world market (mining, steel and pulp and paper).

Therefore these data suggest that investment is still being led by the external sector. The exchange rate appreciation provides a negative incentive which, so far, was compensated by high prices and by intense competition, compelling participants to invest in order to remain competitive and to maintain their market share.

According to the same study, investments in durable consumer goods (automobile and electronics) accounted for 13% of the total for the period 2003-2006, and are expected to contribute 10% of the total increase in investments for 2008-2011. Since the capacity utilization of manufacturing industry has increased, reaching a record 83% in October 200738, it is possible that those sectors geared towards the domestic market will boost their investments, in spite of increased import competition deriving form the overvalued exchange rate. However, available data do not point to a virtuous circle of consumer – induced investment growth.

Two other indicators strengthen such conclusions. The fastest growing capital goods sectors are those which supply equipment for the energy sector and for construction ; labor productivity in the manufacturing industry is increasing at under 2% per year and such growth slackened during 2007 (Banco Central, 2007).

The virtuous circle is further weakened by the incentives handed out by macro economic policies encouraging the use of external sources of financial supply and equipment, via high interest rates and overvalued exchange rates. Imports of capital goods and intermediary products warm the heart of the Central Bank: they ease the inflationary pressures by rapidly increasing production capacity and total factor productivity. Nonetheless, reliance on imports to supply production goods fits better in the virtuous circle of an export-driven growth39 than in the virtuosity of consumer-investment growth. In fact, as shown above, the bulk of industrial investment is related to the external sector.

4.3. Big Brother is watching

The preceding analysis has highlighted the limitations macroeconomic policies led by the Central Bank impose on the growth regime now envisaged by the

Government – consumer-led expansion and autonomous infrastructure investment. Moreover, this policy reduces the incentive to invest in sectors geared to exports and/or import substitution, despite the fact that the former are the main investors in Brazil. Not all difficulties stem from this policy, but the latter plays a significant role, directly as well as indirectly, as discussed below.

The power of the Central Bank in the Brazilian context goes further – it can break an expansionary cycle, as shown by the 2004 episode, and it may repeat its feat in the near future.

The previous long quote of COPOM members is pertinent since the conditions which led to the rise in the basic rate in 2004 are very similar to those prevailing now. In fact, some are more worrisome. The international scenario is certainly much worse. It is not a tightening of the Fed policy which is at stake but a major crisis, with the US economy at its epicenter. The foreign exchange rate and the rise in imports help keep inflation down and the trade surplus is dwindling. Nonetheless, other external indicators have improved (see Table 2): international reserves have trebled since 2003 and are now equivalent to 18 months of imports, as compared to 12 months in 2003 ; the net foreign debt is below 7% of GNP ; the ratio of net debt over exports fell to 0.56 ; and Brazil represents a much smaller risk for investors than it did in 2004.

As regards internal inflation pressures, the degree of capacity utilization is now higher than it was in mid 2004. It is true that investments have recently increased, more than they had in 2003-2004, but consumer demand has also expanded more. As a consequence the Bank is becoming more edgy about capacity utilization, threatening to increase the interest rate, as shown by the COPOM minutes.

It is unlikely that such threats will accelerate investment decisions, since the latter are taken in firm-specific contexts – a classical problem of collective action. Moreover, the threat increases the uncertainty about the evolution of demand and induces “wait and see” behaviors as regards investments directed to the domestic market, which will reinforce COPOM’s fears in the future, producing a vicious circle for growth.

In other words, to the uncertainty stemming from the international situation is added the uncertainty deriving from the power of the Central Bank. But where from does this power come from?

The traumatic experience of inflation during the period from the failure of the 1986 heterodox Cruzado stabilization Plan to 1994, when the Real Plan finally achieved price stability, certainly plays an important role in providing legitimacy to the Central Bank, which presents itself as the “guardian of stability”. The popularity of the government during the Cruzado era and in the aftermath of the Real Plan has been heeded40. Thus the Central Bank finds important allies within the Government, starting with the Finance Ministry, whose fiscal policy plays a major role in the monetary policy. This alliance is institutionalized in the National Monetary Council.

It is often argued that price stability is of the same nature as a public good, in the sense that nobody can be excluded from its benefits, but the policy summarized above creates some very specific losers and winners. Among the former, borrowers come top of the list. The main borrower is the State41, which paid out a yearly average of 7.3% of GNP over the 2003-2006 period on account of interests (GIAMBIAGI, 2007). The amount spent for Bolsa Familia pales in comparison: it is less than a tenth of interests. By keeping the primary surplus high and thus freeing funds for interest payments, the Finance Ministry plays a major role in this process of resource distribution.

On the other side of the coin, the winners’ side, stand the lenders. Among them, the financial system is primum inter pares: the consolidated balance of Brazilian banks shows that over the 2003-2007 period the volume of net profits of the system trebled, and their profit rates increased from 14.8% in 2003 to 22.9% in 2007 (Valor Econômico, “Lucro dos bancos triplica no governo LULA”, 2008). As shown above (Table 2) the international financial system is an important participant among the winners. Nonetheless, the financial system does not stand alone. Institutional investors, such as pension funds, insurance companies, cash-rich enterprises42 also benefit, as do households of the upper tenth of the income distribution who receive about 45% of the national income, and especially those belonging to the upper 1%, who get a hefty 13% of the national income43. BRUNO’s (2007) figures for the rentier share of national income show that non-financial enterprises and individuals received, on average, 81% of the total rentier share over the 1995-2005 period.

As mentioned above, the exchange rate appreciation is the Siamese brother of the monetary policy and the beneficiaries of the two policies overlap, with the exception of exporters. Among the latter, the large enterprises exporting raw materials and semi-manufactured products are pacified by the combination of high external prices, financial earnings from their huge cash balances, and favorable conditions for investments abroad.

This distribution of losses and gains is not a new phenomenon, since very high real interests have been in force since the debt crisis of the early eighties. My assumption is that over this long period a coalition of interests was formed, structured by the public debt and the high interests earned on such debt. This coalition operates under a tacit agreement that the Brazilian State has to pay high interests and so must do other debtors. In other words, there is a convention firmly grounded on powerful interests, historically consolidated, about the payment of interest rates – a good example of how a path-dependent process unfolds.

Original sin arguments, such as the external debt moratorium of 1987, are often offered as justification, which, in turn, make the award of “investment grade” rank by risk evaluation agencies equivalent to redemption. Such facts as the role of the U.S. Fed in the foreign debt crisis, or the lower rates now paid in countries which started world-wide crises, such as Mexico and Russia, are conveniently forgotten. Notwithstanding the substantial fiscal surplus achieved since the end of the nineties, the State current expenditures are also brought forward to justify the interest rates the State has to pay. More recently, high interest rates have been justified by institutional “failures” such as the limited protection given to creditors and the earmarked credit. As shown above, the LULA administration hastened to remedy the former but its consequences in terms of interest rates reduction remain to be seen. As for the latter, its maintenance shows the limits of the power of the financial coalition.

Such a coalition of private interests holds powerful instruments to convey its messages. The most explicit lay in the hands of the financial system, as exemplified by the crisis of the second semester of 2002 which so effectively tamed the incoming government. But there are other instruments, not so explicit, such as the financing of political campaigns44 and the connections to Congress members. The waning of the prestige of the Executive since the debacle of the developmental State in the eighties certainly helps.

The Central Bank is a necessary member of this coalition – it is the institution which conceives and implements monetary policy and the financial sector is its agent. Notwithstanding the growth of government bonds held by foreign investors, their local currency denomination tends to strengthen the links between the Finance Ministry, the Central Bank and the local financial system.

The Bank’s participation in the coalition does not imply a “capture” in public choice fashion – it suffices that the Central Bank and the private members of the coalition derive joint benefits from the same policy. For instance, it is plausible to suppose that the recent reluctance of the Central Bank to increase the basic rate may be influenced by the high profits the financial system is earning with the present credit boom, which, in turn, increase the “soundness” of the system.

Power is a very strong driver and after the Real Plan the Central Bank has enjoyed enormous power. During the first CARDOSO government (1995-1998) it imposed its quasi-fixed over-valued exchange rate policy, in spite of the opposition of very powerful interests (e.g. exporters, local industry besieged by import competition), even within the Government itself45. Its power was increased under the inflation-targeting system adopted during the second CARDOSO mandate (1999-2002), after the predicted foreign exchange crisis came true. Within LULA’s government this power is even greater. A technocratic pride in performing a role which is seen as pedagogic and therapeutic, no matter how much the medicine hurts, is evident in the Bank’s rhetoric.

The cohesion of this coalition is strengthened by a conservative bias: private interests want to preserve the highly profitable status quo, the Central Bank wants to preserve the price system. Both oppose structural changes which would alter wealth and income distribution and relative prices, increasing the risk of inflation. As a consequence the coalition uses its power not only to foster policies for its own benefit, but also to veto policies which may alter the status quo. “Development projects” which may lead to structural changes are therefore excluded.

The cohesion is further strengthened by how monetary policies are implemented. The Central Bank has to keep close and continuous contacts with the agents it regulates, as does every regulatory agency. These contacts are formal and informal and play a part in shaping shared beliefs and expectations. The use of inflation expectations by the financial institutions to calibrate the Central Bank’s own expectations is but a codified example of this process.

Shared belief is strengthened by keeping the policy horizon short. Inflation targets are set a year and a half ahead and COPOM meetings, where the policy may be changed, are held every forty days. The meetings are preceded by innumerable statements by members of the financial community about their expectations about the COPOM decision.

As already pointed out, this produces substantial uncertainty over the long and even the short run. Such uncertainty and the short horizon are antithetical to the formation of a long-term development convention.

Finally, the cohesion of the coalition is strengthened by a shared belief in the legitimacy of the “market” as the main institution in charge of organizing and driving the economy and the society. This belief legitimates the use of their power to veto projects and policies which may reduce the power of the market in favor of other institutions. As such, the range of feasible development projects is severely restricted.

In this respect, the unresolved crisis of the State plays into the hands of the coalition. The developmental State led the country for thirty years, up to the end of the seventies, and agonized during the eighties, losing legitimacy as growth petered out and inflation soared. The neo-liberal years, from 1990 to 2002, introduced some important changes, such as privatization of most State-owned enterprises, but baulked at the prospect of introducing major political and administrative reforms which would make the State more politically representative and capable of a better governance.

Congress holds considerable power in Brazil. The government is in the minority at the Senate and its majority in the lower chamber is shaky. Constrained politically in the Congress as it was economically by the above mentioned coalition, LULA’s Government opted for an equally conservative strategy as regards the State. The relationship between the Executive and Legislative powers remained the same, civil society participation was translated into co-optation, a tradition going back to the thirties, and the reform of the political party system has been as cautious as can be. Although lack of space precludes a fuller discussion on such issues, it seems fair to conclude that the political strategy of the Government has reinforced the financial coalition, further undermining Government efforts to launch a long term development project.

To sum it up, the preceding analysis argued that LULA’s government put forward several development projects but has only implemented such projects partially, in an awkward combination of elements of the developmentalist and liberal heritages. Actually, the Government positive agenda has focused on keeping inflation under control by a very orthodox macroeconomic policy, reducing the foreign exchange constraint by stimulating primary exports and capital inflows, increasing international autonomy and improving the lot of the underprivileged by fiscal transfers and by increasing the minimum wage. Although it was recently hoped that growth would come from investing in infrastructure and from a virtuous circle between household consumption (fuelled by credit) and private investments, growth remains highly dependent on the evolution of the international economy.

The inclusion of poverty as a top priority problem is the single most important change introduced by LULA’s government in the national agenda, even if the solution given to such problem via fiscal transfers is subject to many criticisms of a structural nature. The national autonomy sought by the foreign policy and industrial policies targeting specific sectors are a change compared to preceding governments, but they are part of a long standing Brazilian tradition. Otherwise, it is essentially an agenda of incremental change, in scope and practice. Its success is enhanced by the failure of the liberal model, in as much as some of the positive results (e.g. personal earnings, employment) are a move towards past levels. Macroeconomic policies followed by the Government imply that earnings for the “very rich” are maintained, limit all the long term development projects, and show a built-in conservative bias against structural change.

I suggest that a political economy approach can help understand such phenomena. More specifically, I suggest that a powerful coalition between private interests and the Central Bank developed over the last quarter of a century, which reinforced after the mid-nineties, and that this coalition has the power to impose policies for its own benefit and to veto alternative policies. The weakness of social movements and the deadlock about the reform of the State has strengthened this coalition. Path-dependency and cumulativeness are strong factors in this process.

International conditions prevailing from the beginning of LULA’s government until the last quarter of 2007 favored the macroeconomic policies it adopted. Their change to the worse following the sub-prime crisis will reinforce the restrictive aspects of such policies.

The analysis is centered on the Brazilian case. Although this case presents some extreme features, such as the high interest rates charged and the inequality of income distribution, it is but one of a kind. Similar macroeconomic policies are practiced in most developed countries, Central Banks have adopted inflationtargeting as their best practice and the consequences are the same. In countries where there was a strong tradition of State intervention, such as France, the stalemate about the roles of the market and State seem to be very similar to the Brazilian one.

Let us conclude with a comment on development theory. We all know KEYNES’ remark about “practical men” being guided by long-dead economists. Theory, as history, matters. I have equated above a “development project” to a “development convention” and theory plays an important role in providing some coherence to the several components of the convention and in guiding decision-makers.

The days in which FUKUYAMA proclaimed the “end of History” and WILLIAMSON dubbed the Washington Consensus the “Universal Consensus” which “summarized the common core of wisdom embraced by all serious economists” are long past46. They have been superseded by the international crises of the nineties, the failure of show-cases such as Argentina, and the success of heterodox development paths as followed by China, India and Vietnam, among others. Gone also are the laundry-lists of institutional reforms to be applied urbi et orbi to promote “good governance” and thus to transform Zambia into Sweden overnight. “Big bangs” lost their gilt. Given its results, the demise of such a convention should be commemorated.

Diversity, a hallmark of old developmentalism, has made a comeback: countries follow different trajectories. Institutions change gradually, the polity plays an important role in institutional change, institutions may be formally identical and operate differently depending on their context. Political economy is back, “history matters”, path-dependency and cumulativeness are important. Even “industrial policies”, those bad word, have had a reprieve by none less than the World Bank (2007).

However, behind the recognition of diversity and the caution about general recipes, lies, unabated, the belief in the need for “sound fundamentals”. This is a set phrase with strong rhetorical power (as was “rational” expectations) because nobody is in favor of “unsound” fundamentals. The problem lies in how one defines “soundness”.

The canonical answer now is fiscal equilibrium, low inflation and flexible exchange rate. Given soundness and a well working price mechanism, growth will follow suit. If it doesn’t it is either because some institutions are not working properly (each case is now different) or/and because path dependency leads the agents to hold bad expectations about inflation. To remedy the former, introduce institutional reform (bearing in mind the context). As for the latter, stick to your guns and keep firing until expectations change and a new trajectory is established. It takes time but, as one humorist has put it, “in the end all will be well, and if it is not well yet it is because it has not ended”. The Central Banks have become the high-priests of this canon and to fulfill their role they must be free and independent.

Such definition partakes in the faith on the market with the neo-liberal convention, but it is much more sanguine about macro-economic policies, as it takes a firmer stand on monetary and foreign exchange policies. Moreover, as argued above, their scope are more limited and the horizon shorter than the ones put forward by the neo-liberal convention.

Nonetheless, we have a “sound” convention, with all its attributes. But, is it a development convention? In so far as development is interpreted as implying structural changes and a long term prospective, the answer is negative. The developmental convention focused on changes in the productive structure, the neo-liberal convention on the institutional structure. Both had a long term horizon. The “sound” fundamentalists focus on stability and their convention looks, at best, at the near future only. It is, in this sense, essentially conservative, especially where the interests it serves are being well-cared for. The Brazilian case illustrates how well it works.

Referências Bibliográficas

ARTUS P. (2007) Les incendiaires. Les banques centrales dépassées par la globalisation, Perrin, Paris.

Banco Central do Brasil (2007) Relatório de Inflação, December 2007, Brasília.